A SOC 1 (System and Organization Controls 1) report is a type of attestation report that evaluates the effectiveness of a service organization’s internal controls over financial reporting (ICFR). It is issued under the AICPA’s SSAE 18 standard and is specifically intended for user entities and their auditors as part of their financial statement audits.

Why Does The SOC 1 Report Matter?

SOC 1 reports help user organizations gain assurance that a third-party service provider (like payroll processors, SaaS platforms, or financial transaction processors) has appropriate controls in place to ensure data accuracy, integrity, and confidentiality in financial operations. They are critical for:

- Regulatory compliance: A SOC 1 report supports compliance with financial regulations like SOX by validating that service organizations have controls in place over financial data.

- Internal risk assessments: It helps identify and mitigate control gaps that could compromise the accuracy and integrity of financial reporting.

- Third-party vendor due diligence: SOC 1 reports provide assurance to clients that their financial data is securely handled by compliant third-party service providers.

Who Needs a SOC 1 Report?

Service organizations that impact a client’s financial statement audit typically need SOC 1 compliance. Common examples include:

- Payroll processors

- Loan servicing companies

- Financial software providers

- SaaS platforms managing accounting systems

- Transaction processing firms

These entities need a SOC 1 audit to provide third-party risk assurance and demonstrate financial reporting controls to auditors and clients alike.

SOC 1 Type I vs SOC 1 Type II

SOC 1 Type I focuses on the design of controls and evaluates them at a specific point in time, offering a basic level of assurance.

In contrast, SOC 1 Type II assesses both the design and operating effectiveness of controls over an extended period (typically six months or more), providing a higher level of assurance for stakeholders.

SOC 1 Type I is ideal for first-time reports or readiness assessments, while SOC 1 Type II is preferred by clients and auditors due to its extended evaluation of IT general controls and financial safeguards.

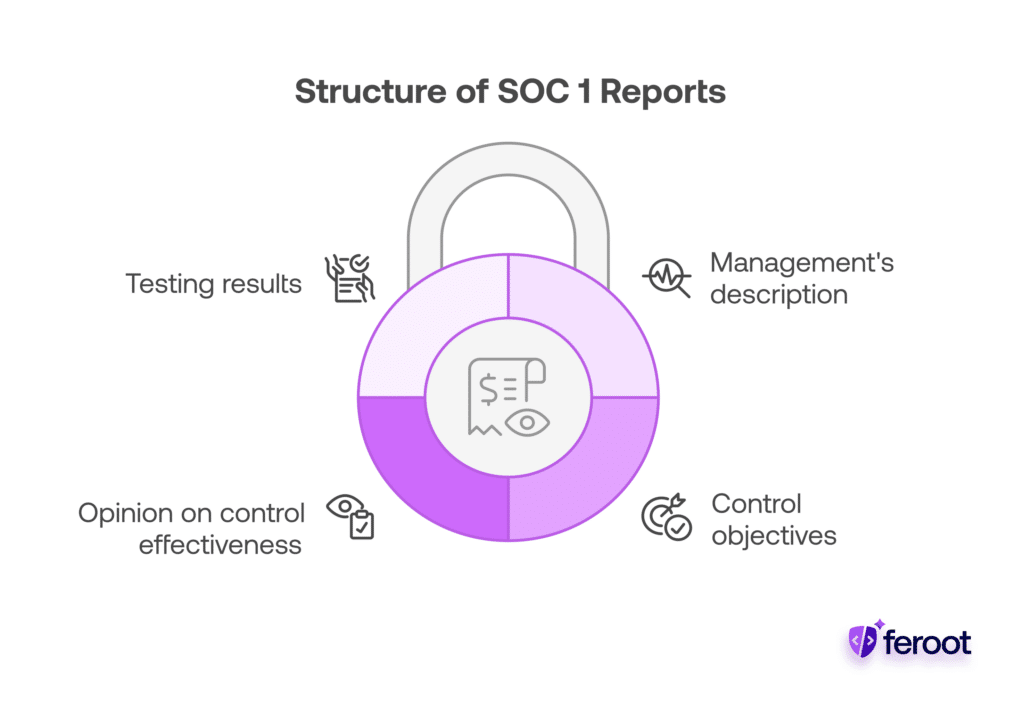

Components of a SOC 1 Report

A standard SOC 1 report includes:

- Management’s description of the system

- Control objectives and related controls

- The auditor’s opinion on control effectiveness

- Testing results (included in Type II reports only)

These components help establish trust and clarity for user entities and their auditors, supporting financial statement audit processes and vendor management compliance.

Key Takeaways

- SOC 1 reports assess financial reporting controls at service organizations.

- SOC 1 Type I focuses on control design, while Type II evaluates effectiveness over time.

- Required for service providers affecting financial audits or ICFR.

- SOC 1 compliance builds third-party trust, mitigates risk, and aligns with the SSAE 18 standard.