Summary

- The Cardholder Data Environment (CDE) refers to systems and networks that store, process, or transmit cardholder data.

- PCI DSS compliance applies fully to all assets within the CDE.

- Common CDE components include payment applications, databases, and connected APIs.

- Misconfigured client-side code can extend the CDE into the browser without proper controls.

- Segmentation and monitoring are essential to reduce CDE scope and risk.

What Is the Cardholder Data Environment?

The Cardholder Data Environment (CDE) is defined by the Payment Card Industry Data Security Standard (PCI DSS) as the people, processes, and technologies that store, process, or transmit cardholder data or sensitive authentication data.

This includes not just the obvious systems like payment processors and databases, but also:

- Web pages and scripts that collect card data

- APIs connected to payment flows

- Systems that support or interact with cardholder data, even indirectly

If cardholder data touches it, it’s in scope—and must meet PCI DSS requirements.

What Is Considered Cardholder Data?

According to PCI DSS, cardholder data (CHD) includes:

- Primary Account Number (PAN)

- Cardholder name

- Expiration date

- Service code

If a system stores or transmits the PAN, it automatically falls within the CDE and must be secured under PCI DSS. Systems that only handle truncated or tokenized PANs may be out of scope—but only if properly segmented.

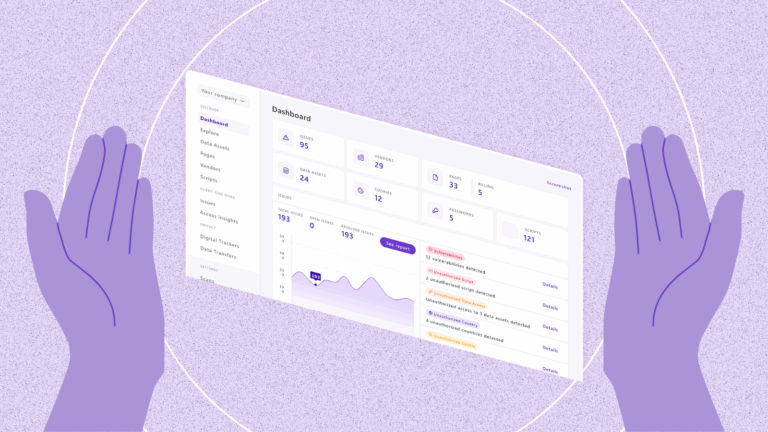

Why Does the Cardholder Data Environment (CDE) Matter for PCI DSS Compliance?

The scope of your Cardholder Data Environment (CDE) defines how much of your IT environment needs to comply with PCI DSS. The larger your CDE, the more controls you must implement—from encryption and access controls to logging, vulnerability scanning, and audit trails.

This has two major implications:

- Cost and effort: A bigger CDE means more complexity and expense to maintain compliance.

- Risk: If a breach occurs in any system within the CDE, it’s a PCI violation—even if the rest of your environment is secure.

That’s why many organizations prioritize reducing and segmenting their CDE.

What Expands or Shrinks the Cardholder Data Environment (CDE)?

Several factors influence CDE scope:

- Connected systems: Any system with network access to cardholder data systems may be in scope.

- Shared credentials or authentication: If users can move freely between systems, those systems become part of the CDE.

- Client-side scripts: JavaScript used on payment pages can unintentionally expose card data to third-party tools, pulling the browser and external code into scope.

Organizations should use network segmentation, access controls, and client-side security to contain the CDE.

How Does the Browser Fit into the Cardholder Data Environment (CDE)?

Modern PCI DSS guidance (especially PCI DSS 4.0, Requirements 6.4.3 and 11.6.1) recognizes that client-side risks—such as rogue JavaScript, shadow code, or third-party trackers—can bring the browser into the CDE.

For example:

- A checkout page uses a script from a marketing tag manager.

- That script loads additional code from an ad network.

- If any of this code can access cardholder input, it falls under PCI DSS scope—even if it’s hosted externally.

Client-side environments must be monitored and controlled, or they could trigger PCI violations.

FAQ

Can I limit the size of my CDE?

Yes. Using tokenization, network segmentation, and role-based access controls can reduce which systems fall under PCI DSS scope. Minimizing the number of systems handling PAN is key.

Is my web page part of the CDE if it collects card info via iframe?

Possibly. If the iframe is truly isolated and no page scripts can access card input, the parent page may be out of scope. But if scripts have access to the form, it’s in scope.

How often should I review my CDE boundaries?

PCI DSS requires regular risk assessments. Best practice is to review CDE boundaries quarterly or when introducing any new payment tech, third-party scripts, or marketing tags.

Conclusion

The Cardholder Data Environment is the core focus of PCI DSS—and the more systems it includes, the harder it is to secure and certify. Organizations must:

- Identify all systems that store, process, or transmit CHD

- Monitor both server-side and client-side entry points

- Minimize scope through segmentation, controls, and tokenization

A secure, well-defined CDE not only reduces PCI burden—it protects your customers and brand.