A PCI DSS assessment evaluates your organization’s compliance with standards set by the Payment Card Industry Security Standards Council. Depending on your card transaction volume, you’ll either complete a Self-Assessment Questionnaire (SAQ) or work with a Qualified Security Assessor (QSA) to conduct a formal PCI audit process.

PCI DSS compliance ensures secure handling of payment card data through rigorous audit procedures, risk mitigation, and implementation of validated security controls. A comprehensive PCI DSS risk assessment identifies vulnerabilities in your payment processing systems and establishes protocols to safeguard sensitive cardholder information.

Organizations that successfully complete their assessment receive PCI DSS validation, confirming they meet the necessary security requirements to protect payment card data. This validation is documented in a PCI Report on Compliance (ROC) for larger businesses or through completed Self-Assessment Questionnaires for smaller merchants.

Who Needs to Comply with Payment Card Industry Compliance?

Any business that stores, processes, or transmits cardholder data must comply with the Payment Card Industry Data Security Standard (PCI DSS). This includes:

- Retailers and brick-and-mortar merchants

- E-commerce businesses and online stores

- SaaS platforms handling payment information

- Payment processors and gateways

- Financial institutions issuing payment cards

- Service providers with access to cardholder data

- Healthcare organizations processing payment information

- Educational institutions accepting tuition payments

The scope of compliance depends on your transaction volume and how you process payments, which determines your PCI DSS compliance level.

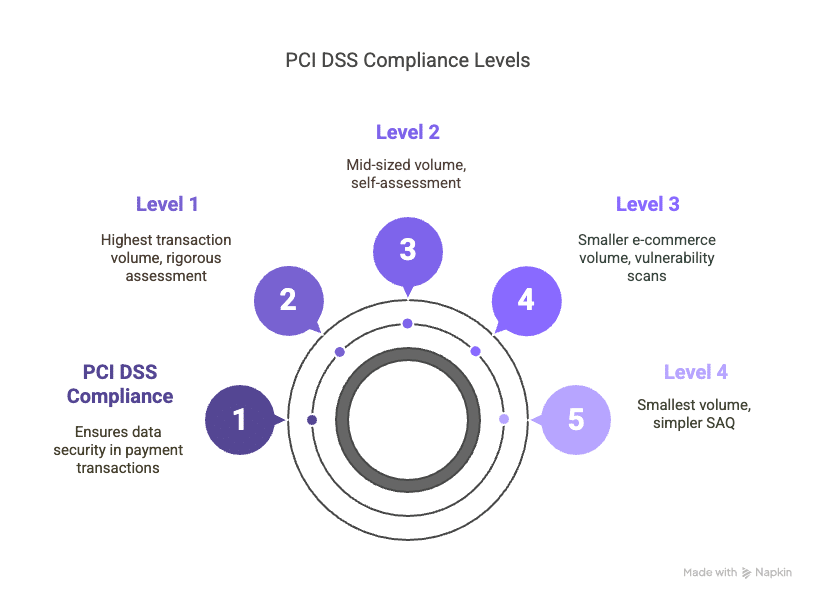

PCI DSS Compliance Levels Explained

The Payment Card Industry Data Security Standard establishes four compliance levels based primarily on transaction volume. Understanding your organization’s compliance level is crucial as it determines the validation requirements and assessment procedures you must follow.

Level 1: Enterprise Merchants

- Transaction Volume: Over 6 million card transactions annually across all channels

- Assessment Requirements: Annual on-site assessment by a Qualified Security Assessor (QSA) or Internal Security Assessor (ISA)

- Validation Documentation: PCI DSS Level 1 merchants must submit a PCI Report on Compliance (ROC) annually

- Additional Requirements: Quarterly network scans by an Approved Scanning Vendor (ASV) and penetration testing

- Who Typically Qualifies: Large retailers, global e-commerce platforms, major service providers

PCI DSS Level 1 compliance represents the most rigorous validation process, requiring comprehensive documentation of all security controls and PCI DSS testing procedures. Organizations at this level must maintain continuous compliance rather than point-in-time validation.

Level 2: Mid-Sized Merchants

- Transaction Volume: 1-6 million transactions annually

- Assessment Requirements: Annual Self-Assessment Questionnaire (SAQ) or optional on-site assessment

- Validation Documentation: Completed SAQ, quarterly ASV scans, Attestation of Compliance

- Who Typically Qualifies: Regional retailers, medium-sized e-commerce businesses

Level 3: Smaller Merchants

- Transaction Volume: 20,000-1 million e-commerce transactions annually

- Assessment Requirements: Annual SAQ, quarterly vulnerability scans

- Validation Documentation: Completed SAQ and scan reports

- Who Typically Qualifies: Small online businesses with significant transaction volume

Level 4: Small Merchants

- Transaction Volume: Under 20,000 e-commerce transactions or up to 1 million regular transactions annually

- Assessment Requirements: Annual SAQ (simpler versions based on processing environment)

- Validation Documentation: Completed SAQ, may require quarterly scans depending on processing methods

- Who Typically Qualifies: Small businesses, independent retailers, small online shops

Each card brand (Visa, Mastercard, American Express, Discover, JCB) may have slightly different thresholds for these levels, so merchants should verify their specific compliance level with their payment processor or acquiring bank.

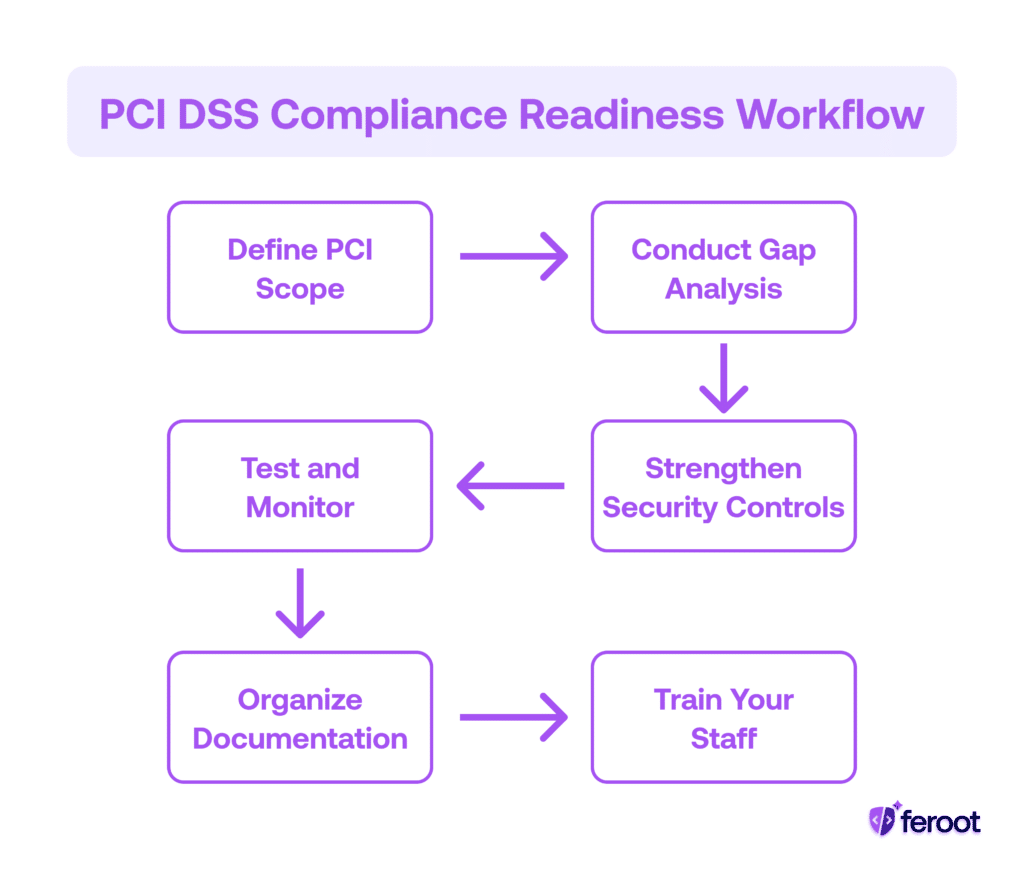

How to Prepare for a PCI Compliance Assessment: Step-by-Step

1. Define Your PCI Scope

Begin by identifying all systems that store, process, or transmit cardholder data, known collectively as the Cardholder Data Environment (CDE). This includes point-of-sale systems, payment applications, databases, and network components that connect to these systems.

To reduce the compliance burden, apply network segmentation to isolate systems that fall within PCI scope. Properly implemented segmentation can significantly reduce assessment complexity by limiting the number of systems subject to PCI DSS requirements. Feroot Security’s solutions help organizations accurately identify and map their cardholder data environment, ensuring complete visibility into your PCI scope.

2. Conduct a Gap Analysis

Evaluate your current environment against PCI DSS requirements to uncover any deficiencies. A thorough PCI DSS risk assessment will identify areas where your security controls fall short of the standard’s requirements.

Address high-risk or non-compliant areas before moving forward with the formal assessment. This proactive approach helps prevent failed audits and costly remediation efforts later in the process.

3. Strengthen Security Controls

Ensure cardholder data is encrypted both in transit and at rest. Implement strong access control measures, including:

- Unique user IDs for all personnel with system access

- Role-based permissions limiting access to only what’s needed

- Two-factor authentication for remote access to the network

- Regular review and updating of access privileges

Maintain centralized audit logs with active monitoring to track and monitor all access to network resources and cardholder data. Implement a robust vulnerability management program that includes regular patching and updates to systems within the cardholder data environment. Feroot Security’s continuous monitoring capabilities provide real-time insights into threats targeting your payment environment, allowing for immediate response to potential vulnerabilities.

4. Test and Monitor

Conduct internal vulnerability scans and penetration tests regularly. The PCI DSS testing procedures require:

- Quarterly internal vulnerability scans

- Quarterly external scans by an Approved Scanning Vendor (ASV)

- Annual penetration testing of both network and application layers

- Testing after any significant infrastructure or application change

Any issues identified should be remediated before the official assessment begins. Document your testing methodology and results as evidence for your assessment.

5. Organize Documentation

Keep all relevant security policies, procedures, and system logs up to date and readily available. Documentation should include:

- Information security policies

- Network diagrams showing cardholder data flows

- System inventory with PCI scope designations

- Vendor management procedures and compliance status

- Incident response plans

- Evidence of security awareness training

Prepare thorough documentation to demonstrate how each PCI control is implemented across your environment. This documentation forms the foundation of your PCI Report on Compliance or Self-Assessment Questionnaire.

6. Train Your Staff

Provide PCI DSS training for employees responsible for handling cardholder data or managing system security. Staff should also be familiar with your organization’s incident response plan and understand their role in maintaining compliance.

Regular security awareness training ensures all employees understand the importance of protecting cardholder data and following security policies and procedures.

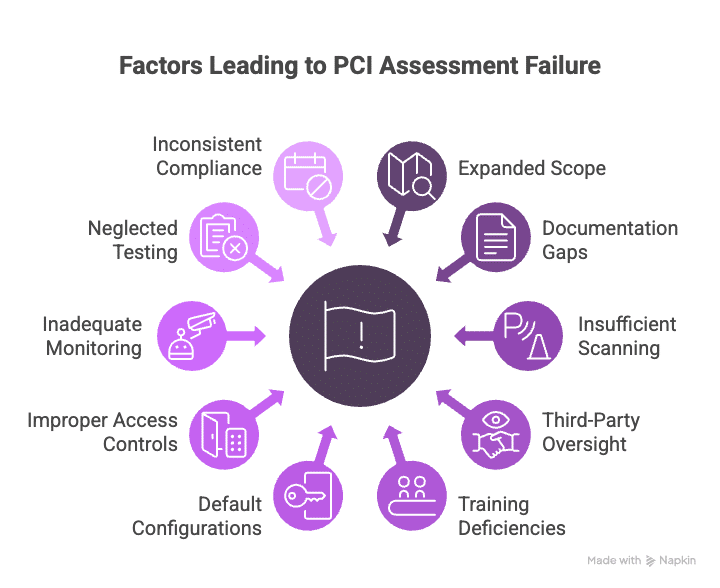

Where PCI Assessments Often Fail – What You Should Avoid

- Expanded Scope: Failing to properly segment networks, unnecessarily expanding the compliance scope

- Documentation Gaps: Outdated or missing documentation of security policies and procedures

- Insufficient Scanning: Infrequent vulnerability scanning or failure to remediate identified issues

- Third-Party Oversight: Failure to validate third-party service provider compliance

- Training Deficiencies: Lack of employee training on data security policies

- Default Configurations: Using vendor-supplied defaults for system passwords and security parameters

- Improper Access Controls: Failing to restrict physical access to cardholder data and systems

- Inadequate Monitoring: Not implementing comprehensive logging and monitoring systems

- Neglected Testing: Skipping regular security testing of systems and processes

- Inconsistent Compliance: Treating compliance as a point-in-time event rather than ongoing process

How to Become PCI Compliant: Key Requirements

The PCI DSS framework consists of six main control objectives containing 12 requirements that organizations must meet to achieve compliance:

1. Build and Maintain a Secure Network

- Requirement 1: Install and maintain a firewall configuration to protect cardholder data

- Requirement 2: Do not use vendor-supplied defaults for system passwords and security parameters

2. Protect Cardholder Data

- Requirement 3: Protect stored cardholder data through encryption, truncation, or tokenization

- Requirement 4: Encrypt transmission of cardholder data across open, public networks

3. Maintain a Vulnerability Management Program

- Requirement 5: Use and regularly update anti-virus software

- Requirement 6: Develop and maintain secure systems and applications

4. Implement Strong Access Control Measures

- Requirement 7: Restrict access to cardholder data by business need-to-know

- Requirement 8: Assign a unique ID to each person with computer access

- Requirement 9: Restrict physical access to cardholder data

5. Regularly Monitor and Test Networks

- Requirement 10: Track and monitor all access to network resources and cardholder data

- Requirement 11: Regularly test security systems and processes

6. Maintain an Information Security Policy

- Requirement 12: Maintain a policy that addresses information security for all personnel

For merchants looking to achieve and maintain compliance with PCI DSS, understanding these requirements and implementing appropriate controls is essential. The specific implementation details will vary based on your organization’s size, complexity, and PCI compliance level.

PCI Compliance for Merchants: Special Considerations

Merchants face unique challenges in achieving PCI compliance, particularly when balancing security requirements with business operations. Some key considerations include:

E-commerce Websites

PCI DSS requirements for websites handling payment data include:

- Maintaining secure coding practices

- Implementing proper TLS encryption for transmission of cardholder data

- Regular security testing of web applications

- Using PCI-validated payment gateways

Feroot Security specializes in protecting e-commerce websites from client-side attacks that can compromise cardholder data. Our solutions detect and prevent threats like formjacking, Magecart, and other client-side vulnerabilities that traditional security tools often miss.

Small and Medium-Sized Businesses

Smaller merchants can simplify compliance by:

- Using validated payment terminals

- Leveraging point-to-point encryption (P2PE) solutions

- Implementing tokenization to remove actual card data from their environment

- Choosing the appropriate Self-Assessment Questionnaire based on their payment processing methods

Multi-Channel Retailers

Businesses accepting payments through multiple channels must:

- Ensure consistent security controls across all channels

- Maintain separate documentation for different processing environments

- Consider consolidated payment processing to reduce complexity

How Feroot PaymentGuard AI Streamlines PCI DSS Assessment

Achieving and maintaining PCI DSS compliance can be complex and resource-intensive. Feroot PaymentGuard AI offers innovative solutions that simplify the assessment process while strengthening your security posture.

Automatic Script Inventory & Monitoring

PaymentGuard AI meets Requirement 6.4.3 with automated discovery and continuous monitoring of all payment page scripts. The solution provides complete visibility into every script running on your payment pages with zero manual effort, helping you maintain a comprehensive inventory of all components in your cardholder data environment.

Real-Time Change Detection

With PaymentGuard AI, you can satisfy Requirement 11.6.1 through automated detection of unauthorized modifications to payment pages. The system provides instant alerts when any script changes occur, ensuring continuous compliance and protection. This real-time monitoring capability helps prevent Magecart and formjacking attacks that specifically target payment pages.

Ready-Made Compliance Documentation

Generate audit-ready documentation automatically with PaymentGuard AI. The solution exports comprehensive reports showing script inventory, change history, and compliance status, saving hours of manual documentation work. This documentation is invaluable during PCI DSS assessments, providing QSAs with clear evidence of your security controls.

Zero-Effort Implementation

PaymentGuard AI can be deployed in just 15 minutes with one line of code. No changes to existing systems are required, and the intuitive dashboard provides real-time visibility into your compliance status and script inventory. This simplifies the technical aspects of PCI DSS compliance and reduces the burden on your IT and security teams.

PCI DSS 4.0 Compliance Automation

Feroot PaymentGuard AI helps organizations adapt to the new PCI DSS 4.0 requirements through:

- Quick Setup (5 minutes): One-line deployment and automatic script discovery

- Automated Protection: Continuous monitoring and real-time alerts

- Easy Reporting: Ready-made audit documentation and compliance dashboard

By automating these critical aspects of PCI DSS compliance, PaymentGuard AI helps organizations reduce the time, cost, and complexity of assessments while improving their security posture.

Final Tips and Takeaways

Preparing for a PCI DSS assessment isn’t just about passing a checklist—it’s about building a secure environment for cardholder data. By understanding your scope, closing compliance gaps, and documenting controls, you reduce risk and ensure smoother audits year after year.

Key points to remember:

- PCI compliance is an ongoing process, not a one-time event

- Regular testing and monitoring are essential to maintaining security

- Documentation is crucial for demonstrating compliance during assessments

- Employee training and awareness significantly reduce security risks

- Reducing your cardholder data environment through segmentation and tokenization can simplify compliance

Implementing strong security practices in line with PCI DSS requirements not only helps you achieve compliance but also protects your business and customers from data breaches and their associated costs.

Explore how Feroot PaymentGuard AI can help you automate your PCI DSS compliance, protect payment card data, and streamline your assessment process. Schedule a demo today to see how our solution can save you time and resources while strengthening your security posture.