Summary

- A HIPAA covered entity is any organization directly subject to HIPAA rules.

- This includes healthcare providers, health plans, and healthcare clearinghouses.

- Covered entities are responsible for safeguarding PHI and managing business associates.

- They must comply with the HIPAA Privacy, Security, and Breach Notification Rules.

- Failing to meet these obligations can result in steep civil penalties and reputational damage.

What Is a HIPAA Covered Entity?

A HIPAA covered entity is any organization that creates, receives, maintains, or transmits protected health information (PHI) in connection with certain healthcare-related functions. A HIPAA covered entity is directly regulated under the Health Insurance Portability and Accountability Act (HIPAA).

The U.S. Department of Health and Human Services (HHS) defines three types of covered entities:

- Healthcare providers that electronically transmit health information (e.g., doctors, dentists, clinics, hospitals)

- Health plans, including insurers, HMOs, Medicare, and Medicaid

- Healthcare clearinghouses that process or translate health data between entities

If an organization falls into one of these categories and handles PHI, it must comply with all applicable HIPAA rules.

What Responsibilities Does A HIPAA Covered Entity Have?

A HIPAA covered entity is legally obligated to protect patient health information and limit who can access or share it. Their core responsibilities include:

- Implementing administrative, physical, and technical safeguards under the HIPAA Security Rule

- Providing patients with privacy notices and access to their records under the HIPAA Privacy Rule

- Reporting data breaches involving PHI under the HIPAA Breach Notification Rule

- Establishing Business Associate Agreements (BAAs) with vendors who handle PHI on their behalf

Covered entities must also conduct regular risk assessments, train staff on HIPAA compliance, and document policies for data handling and security.

What’s the Difference Between a Covered Entity and a Business Associate?

While covered entities are the originators and primary handlers of PHI, business associates are third parties that perform functions or services involving PHI on behalf of covered entities.

For example:

- A hospital (covered entity) contracts with a cloud EHR provider (business associate)

- A health insurance company (covered entity) hires a billing agency (business associate)

Covered entities are responsible for vetting their business associates and ensuring there is a signed BAA in place. If the business associate mishandles PHI, both parties may be held accountable.

Why Does It Matter if You’re a Covered Entity?

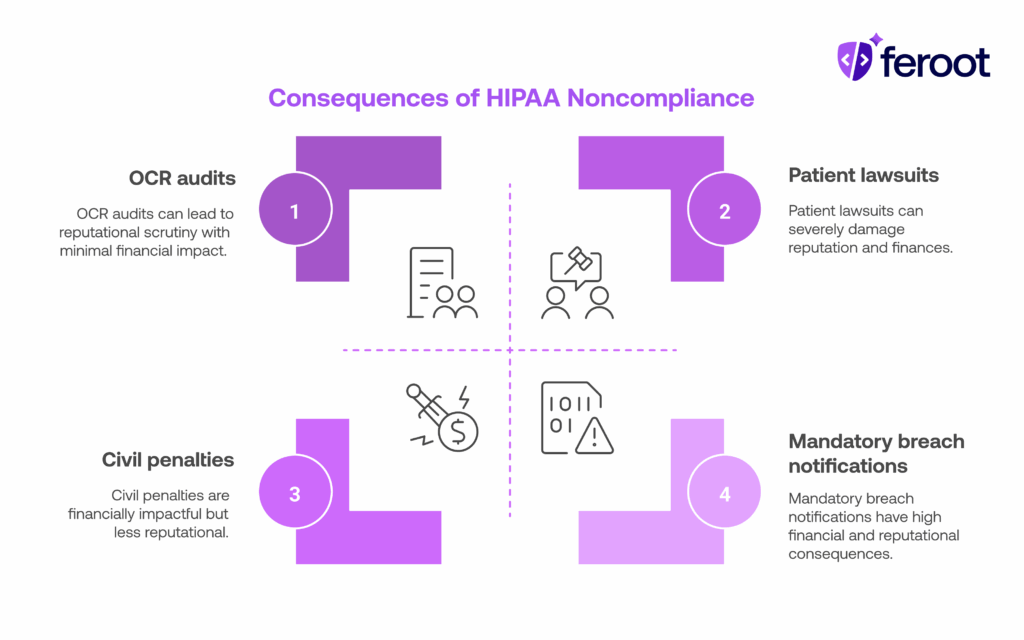

If you’re a covered entity under HIPAA, you face legal obligations and liability for protecting PHI. Noncompliance can result in:

- Civil penalties ranging from $137 to $68,928 per violation (as of 2023)

- Mandatory breach notifications and media disclosures

- OCR audits and reputational damage

- Patient lawsuits or class actions in the event of negligence

Being designated as a covered entity also dictates who you can share data with, which tools you can legally use, and whether you need a BAA with vendors like CRM platforms, analytics providers, or email services.

FAQ

Are all healthcare providers considered covered entities?

Not automatically. Only providers that transmit health information electronically in connection with specific transactions (like billing) are HIPAA covered entities. Most modern providers qualify.

Do covered entities need to worry about website trackers and pixels?

Yes. If your site includes forms, portals, or online scheduling that collect PHI—and uses tools like Meta Pixel or Google Analytics—you may be inadvertently disclosing PHI to third parties, violating HIPAA.

Can a company be both a covered entity and a business associate?

Yes. Some organizations, such as health tech platforms, act as covered entities in one context and business associates in another, depending on their role and data relationships.

Conclusion

A HIPAA covered entity is any organization that handles PHI in a healthcare delivery, payment, or clearinghouse capacity. If you’re a provider, health plan, or healthcare data processor, HIPAA applies to you—and the risk of noncompliance is real.

Covered entities must:

- Understand their legal obligations under HIPAA

- Secure all systems and vendors touching PHI

- Limit exposure from client-side scripts, forms, and tracking tools

- Report breaches promptly and document ongoing compliance

HIPAA is not just about policies—it’s about active, ongoing data governance across your entire ecosystem.