Summary

- A Qualified Security Assessor (QSA) is a PCI SSC-certified professional authorized to assess PCI DSS compliance.

- QSAs conduct formal audits, validate controls, and issue Reports on Compliance (ROCs).

- Level 1 merchants and service providers are often required to engage a Qualified Security Assessor (QSA).

- QSAs also help organizations interpret complex PCI DSS 4.0 requirements.

- Working with a QSA can reduce audit risk and speed up remediation.

What Is a Qualified Security Assessor?

A Qualified Security Assessor (QSA) is an individual who has been trained and certified by the PCI Security Standards Council (PCI SSC) to assess an organization’s compliance with the Payment Card Industry Data Security Standard (PCI DSS).

QSAs typically work for QSA Companies (QSCs)—approved consulting firms that perform assessments on behalf of clients. Only QSAs can officially validate PCI compliance for Level 1 merchants and service providers, issuing a Report on Compliance (ROC) or Attestation of Compliance (AOC).

What Does a QSA Do?

QSAs play a critical role in formal PCI DSS audits. Their responsibilities include:

- Scoping the cardholder data environment (CDE)

- Interviewing staff and stakeholders to verify procedures

- Reviewing security controls, such as firewalls, encryption, and access restrictions

- Examining documentation including policies, network diagrams, and incident logs

- Performing testing and sampling across systems and controls

- Identifying compliance gaps and issuing remediation guidance

- Delivering a signed ROC and AOC for PCI DSS certification

QSAs must adhere to the QSA Program Guide and maintain independence during the assessment.

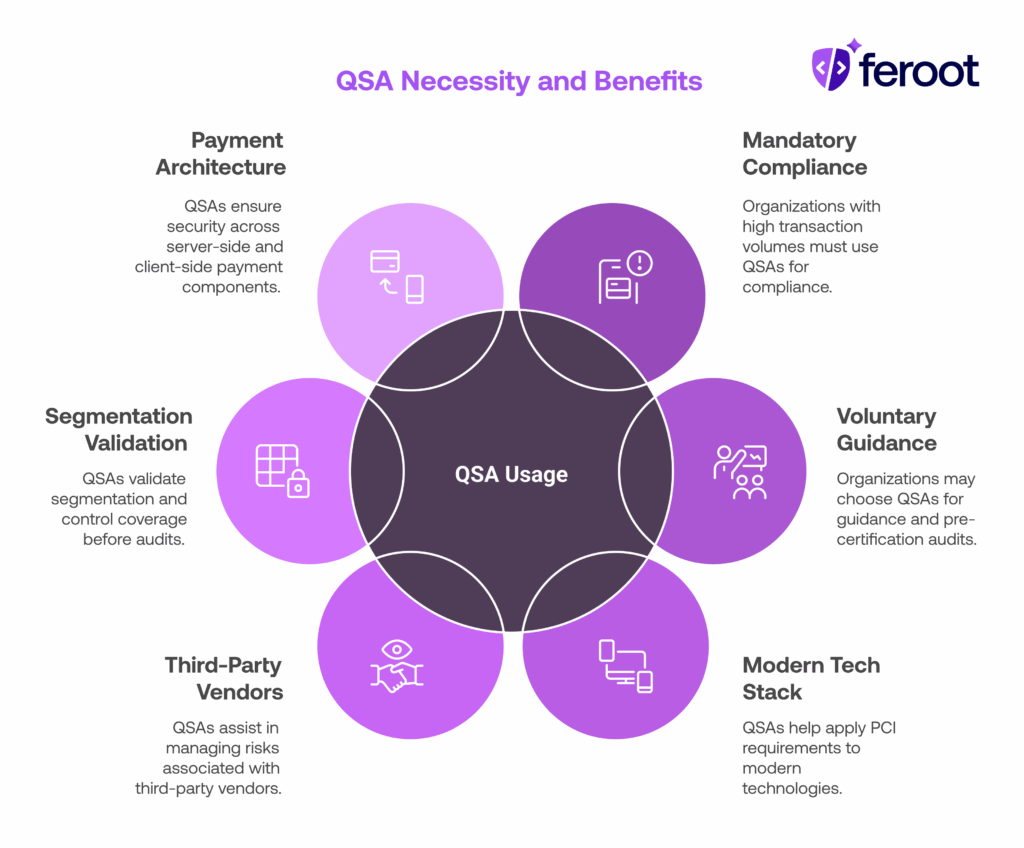

Who Needs a QSA?

Not every organization is required to use a QSA. But for Level 1 merchants (over 6 million Visa transactions per year) or Level 1 service providers, a third-party assessment by a QSA is mandatory.

Others may voluntarily hire a QSA for guidance, gap assessments, or pre-certification audits—especially under the expanded and more prescriptive PCI DSS 4.0 framework.

You may benefit from a QSA if:

- You’re unsure how to apply PCI requirements to a modern tech stack

- You’re using third-party vendors or JavaScript-heavy checkout flows

- You want to validate segmentation or control coverage before an audit

- Your payment architecture includes both server-side and client-side components

Note: Some smaller merchants can self-assess using SAQs, but the scope must be accurate—and a QSA can help ensure it.

Why Are QSAs Important Under PCI DSS 4.0?

With the release of PCI DSS 4.0, many organizations are facing new technical requirements—especially around client-side JavaScript (6.4.3) and real-time change detection (11.6.1).

QSAs help translate these into actionable control decisions, such as:

- What counts as a “script change”

- How to inventory all scripts on payment pages

- Whether a web form or iframe is in-scope

- How to monitor unauthorized third-party behavior

They also serve as a neutral third party to validate that your compensating controls or alternative implementations meet intent-based goals under PCI DSS.

FAQ

Can a QSA help us with remediation planning?

Yes. Many QSA companies offer gap assessments or remediation consulting before the formal audit begins. This helps reduce failed controls in the final ROC.

Is a QSA required if we’re using Stripe or Shopify?

Not always. If you use a fully managed provider and qualify for SAQ A, you may not need a QSA. But if your site collects cardholder data via JavaScript or APIs, a QSA can clarify your scope and risk.

What’s the difference between a QSA and an ASV?

A QSA performs in-depth PCI DSS audits. An ASV (Approved Scanning Vendor) is certified to run external vulnerability scans—required quarterly. Some firms offer both services.

Conclusion

A Qualified Security Assessor is more than just an auditor—they’re your guide through the complex landscape of PCI DSS. Whether you’re facing a mandatory ROC or just need help interpreting new requirements, a QSA provides clarity, assurance, and technical expertise.

Organizations should:

- Know when a QSA is required based on merchant level

- Leverage QSAs for PCI DSS 4.0 interpretation and readiness

- Use their expertise to minimize scope and avoid failed assessments

- Treat the QSA relationship as a strategic compliance investment—not just a checkbox