To address stakeholder feedback and questions received since PCI DSS v4.0 was published, the PCI Security Standards Council (PCI SSC) has published a limited revision to the standard, PCI DSS v4.0.1. It includes corrections to formatting and typographical errors and clarifies the focus and intent of some of the requirements and guidance. There are no additional or deleted requirements in this revision.

Download the Free PCI 6.4.3 and 11.6.1 Checklist

TL;DR

- The cheapest way to comply with PCI DSS is to reduce the scope of your cardholder data environment (CDE).

- Tokenization, segmentation, and client-side security controls are key to minimizing exposure and audit costs.

- Smaller scope means fewer controls to validate, lower technology costs, and faster audit readiness.

- Client-side risks like shadow code can still bring you out of scope — unless they’re monitored and controlled.

- Tools like Feroot PaymentGuard AI help security teams enforce PCI DSS 4.0 controls on the browser side, without costly manual evidence gathering.

Introduction

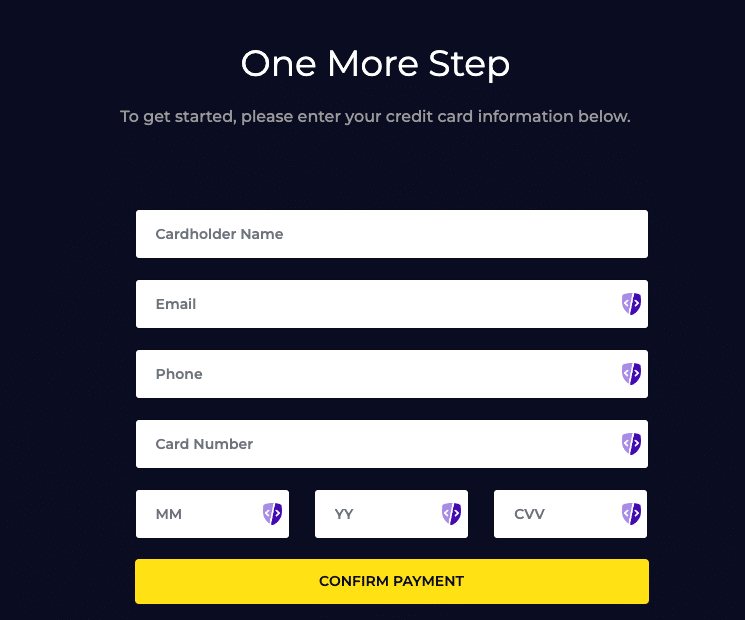

If you’re running a business that takes online credit card payments, you know that you’ve got to become compliant with PCI DSS Requirements 6.4.3 and 11.6.1. Meeting these requirements is crucial for PCI DSS Version 4 Compliance and helps prevent costly data breaches. However, the costs of compliance tools can add up quickly, especially for small businesses. In particular, PCI DSS requirements 6.4.3 and 11.6.1 can seem daunting.

What You Need to Know

These requirements focus on managing web scripts on payment pages to prevent malicious activity and ensuring webpage integrity through consistent monitoring. This involves script integrity monitoring, script inventory tracking, and implementing security measures like Content Security Policy (CSP) for PCI DSS 4. Let’s explore some cost-effective ways to comply with these requirements without breaking the bank.

The Challenge: Affordable PCI DSS Compliance

For many small to mid-sized businesses, costs for third-party PCI compliance tools to meet PCI DSS requirements 6.4.3 and 11.6.1 can range from $10,000 per year. This may seem like an exorbitant price, especially for smaller businesses and small security teams. However, PCI DSS compliance is essential, and cutting corners can cost even more in the long run due to potential data breaches and non-compliance penalties. In this article, we’ll explore some alternatives, including manual vs. automated PCI compliance and affordable solutions from Feroot Security.

Manual Compliance: What are Pros and Cons?

For some businesses, PCI DSS manual compliance is the first thought when high costs deter them from using dedicated solutions. However, manual compliance can be challenging and resource-intensive, especially without specialized web page scanners or script monitoring solutions.

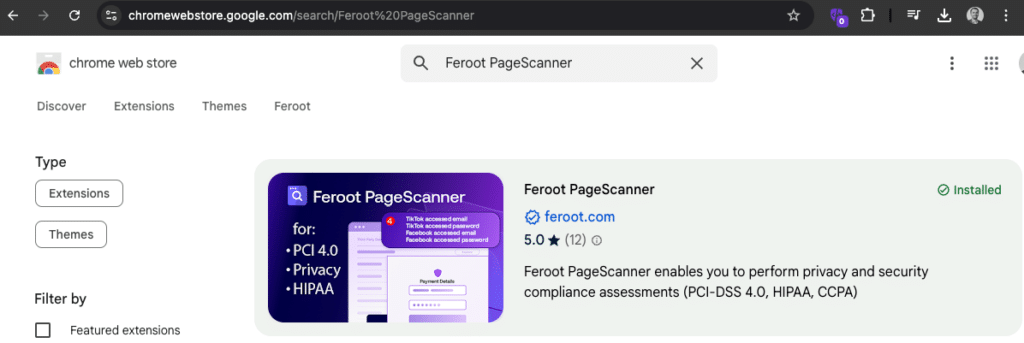

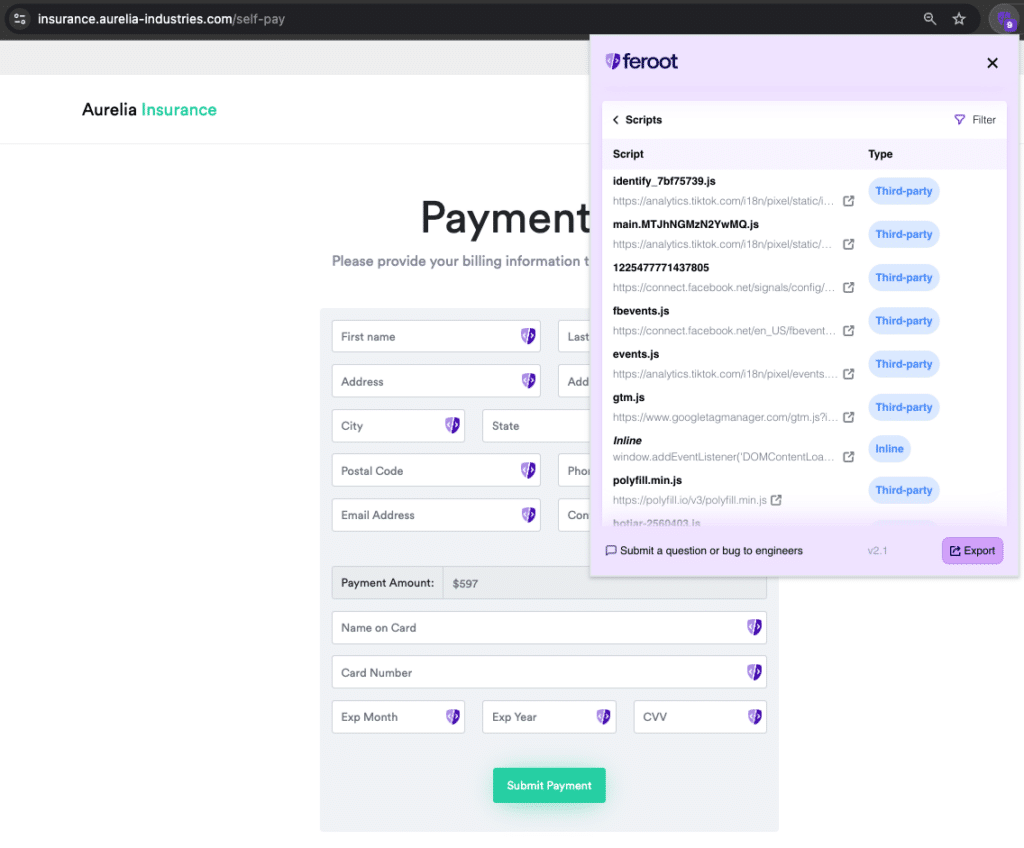

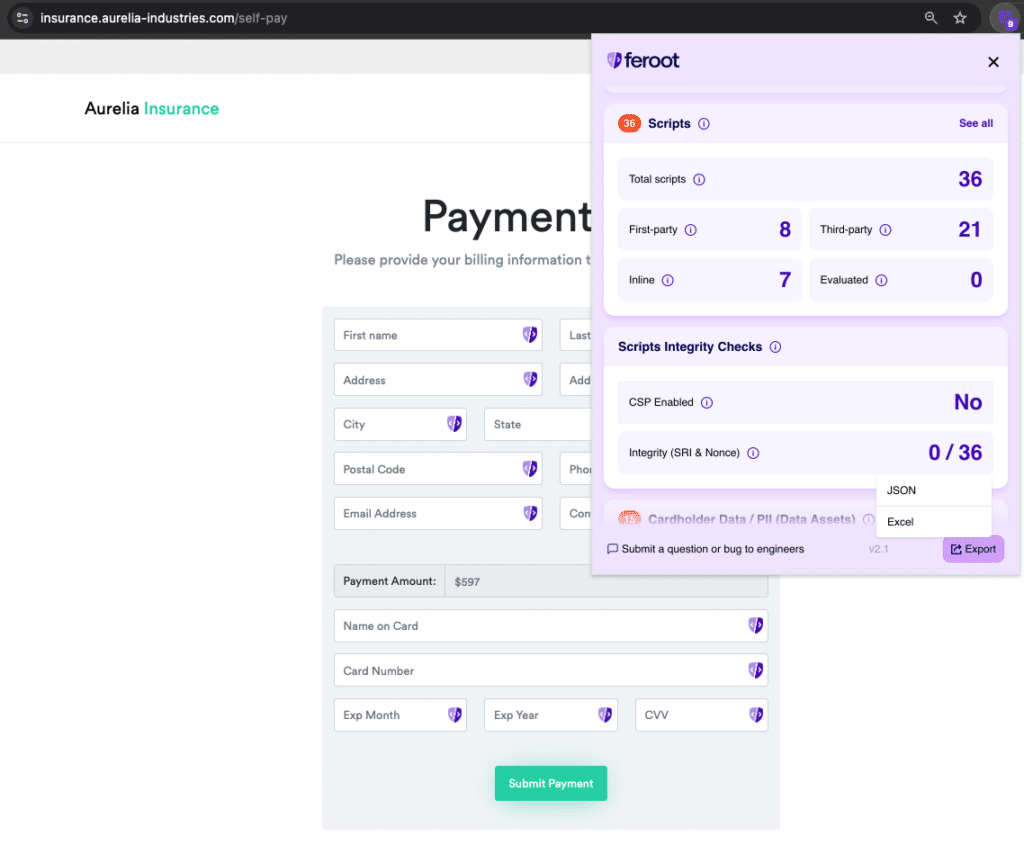

To manually comply with PCI DSS requirements 6.4.3 and 11.6.1, you can use a Chrome browser extension such as PageScanner to:

- Maintain a Script Inventory: Keep an inventory of all scripts running on your payment page and regularly update it (script inventory tracking).

- Ensure Script and Page Integrity: Regularly scan payment pages, comparing current versions with historical ones. PageScanner allows you to export all findings into Excel files or JSON.

You can also use Content Security Policy (CSP) to authorize scripts:

- Implement CSP for PCI DSS 4: Using CSP can prevent unauthorized scripts from running on your site. However, misconfiguration can lead to site disruptions, so expertise in JavaScript security for payment pages is necessary.

Some organizations attempt to use File Integrity Monitoring (FIM) systems to comply with these requirements. However, while FIM can monitor changes to files on your servers, it doesn’t provide visibility into the client side or third-party script security, which is essential for PCI DSS Version 4 Compliance.

The major downside to manual compliance is the cost of human resources. Companies that tried to comply manually ended up spending over $150,000 annually on hiring dedicated employees and cobbling together various tools. This makes manual compliance only feasible for those who have the necessary expertise and extra free time.

How to Automate PCI DSS Compliance on a Small Budget

Feroot Security’s Starter packages begin at $5K per year or $415 per month.

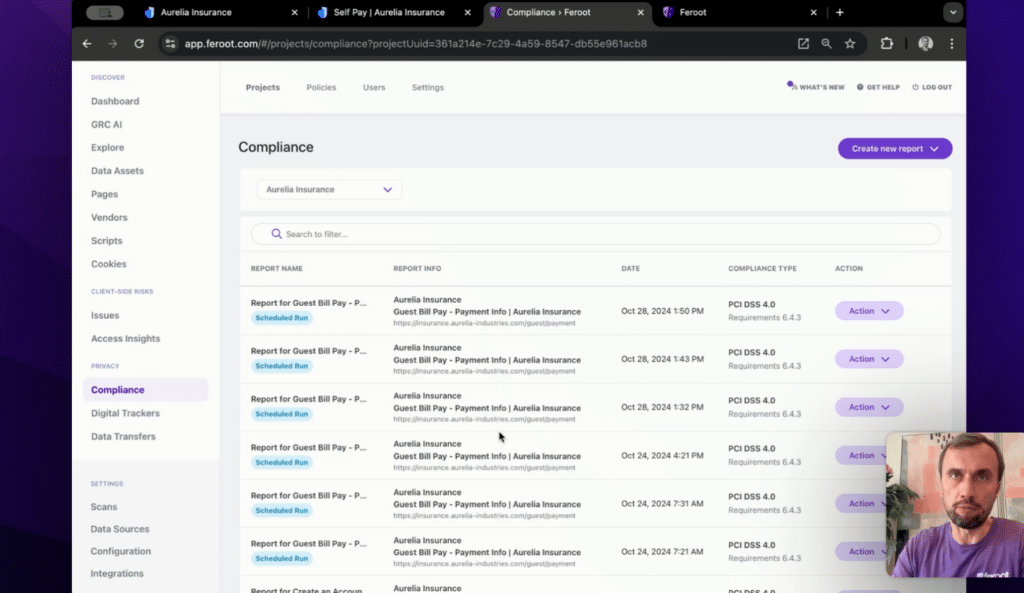

Feroot Security offers a comprehensive solution for managing client-side security, including compliance with PCI DSS requirements 6.4.3 and 11.6.1.

Our Inspector and PageGuard products are designed to help businesses monitor their payment pages, ensure script integrity, and keep sensitive customer data secure—all without the need for costly manual intervention.

With Feroot Security, you get:

- Automated Compliance Tools: Reduce the need for manual intervention and minimize human error.

- Automatic Script Monitoring: Inspector provides real-time monitoring of all scripts running on your payment pages, alerting you to any changes or unauthorized activities (script monitoring solutions).

- Page Integrity Checks: PageGuard ensures that your payment pages remain secure by continuously scanning for unauthorized changes, providing an extra layer of security against Magecart Attacks, e-skimming, and other threats targeting the client side (preventing client-side attacks).

- Automated Tamper Prevention and Detection: PageGuard‘s Script Tag prevents unauthorized changes and detects changes in script activities. The Policy Engine detects and responds to unauthorized changes of script and page content (PageGuard for PCI DSS 4 requirements 6.4.3 and 11.6.1).

- Affordable PCI Compliance Solutions: Feroot Starter packages fit the needs of small to mid-sized businesses, with transparent pricing that won’t strain your budget.

- Enterprise Scale: The Feroot Enterprise Platform automates compliance on hundreds and thousands of websites with up to thousands of unique payment pages and hundreds of millions of monthly active visitors.

While there are many tools that exist to help comply with PCI 4, many of these solutions have limitations and may not provide the comprehensive features or affordability that small businesses need. Feroot Security stands out by offering specialized tools designed specifically to meet PCI DSS 4 requirements 6.4.3 and 11.6.1.

Why Choose Feroot Security for PCI DSS Compliance?

- E-commerce PCI Compliance: Tailored solutions for online businesses handling credit card transactions.

- Client-Side Security Focus: Protect your website from Magecart Attacks and other threats targeting the client side.

- Support from Qualified Security Assessors (QSAs): Our team works closely with PCI DSS Qualified Security Assessors (QSAs) to ensure our solutions meet all compliance standards.

- Third-Party Script Security: Manage and secure scripts from third-party sources on your website.

- Comprehensive Compliance: Stay up-to-date with the latest requirements, including PCI DSS 6.4.3 and 11.6.1 requirements.

Conclusion: Finding the Right Balance Between Cost and Compliance

Complying with PCI DSS requirements 6.4.3 and 11.6.1 doesn’t have to mean spending a fortune. While manual compliance is an option, the cost in terms of labor and potential errors can be prohibitive. Instead, affordable tools like those offered by Feroot Security provide an effective way to stay compliant without overspending.

At Feroot Security, we believe that every business, regardless of size, deserves access to robust PCI DSS compliance solutions that are both easy to use and cost-effective. If you’re looking for a way to meet PCI DSS requirements without breaking the bank, we’re here to help.

Ready to learn more? Contact us today to discuss how Feroot Security can help your business stay secure and compliant, all while keeping costs under control.

FAQs

What’s the most cost-effective way to comply with PCI DSS 4.0?

Reducing your PCI scope using segmentation, tokenization, and browser-side security controls — like those provided by Feroot — is the fastest and cheapest route to compliance. Feroot helps eliminate hidden client-side risks that can unexpectedly expand your scope and increase audit costs.

Why is reducing PCI DSS scope so important?

A smaller scope means fewer systems to secure, fewer requirements to meet, and significantly lower audit and remediation costs.

Can client-side code increase PCI DSS scope

Yes. Unmonitored JavaScript, third-party scripts, and tracking pixels can bring your payment pages back into scope, even if your backend is segmented.

How does Feroot help lower PCI compliance costs?

Feroot’s PaymentGuard AI continuously monitors client-side scripts, maps controls to PCI DSS 4.0 requirements like 6.4.3 and 11.6.1, and generates audit-ready reports — helping teams reduce prep time and avoid scope creep.