TL;DR

- Feroot’s PaymentGuard AI automatically inventories and authorizes all scripts on payment pages to satisfy PCI DSS 6.4.3.

- Feroot’s PaymentGuard AI detects any unauthorized script or HTTP header changes in real time to meet PCI DSS 11.6.1.

- There are no code changes or dev effort required—deploy via JavaScript tag and CSP header.

- Feroot’s PaymentGuard AI generates audit-ready compliance reports instantly, aligned with QSA evidence needs.

- Ideal for security teams strapped for resources, reducing audit prep time by up to 95%.

Why Are CISOs Still Managing PCI DSS Compliance Manually?

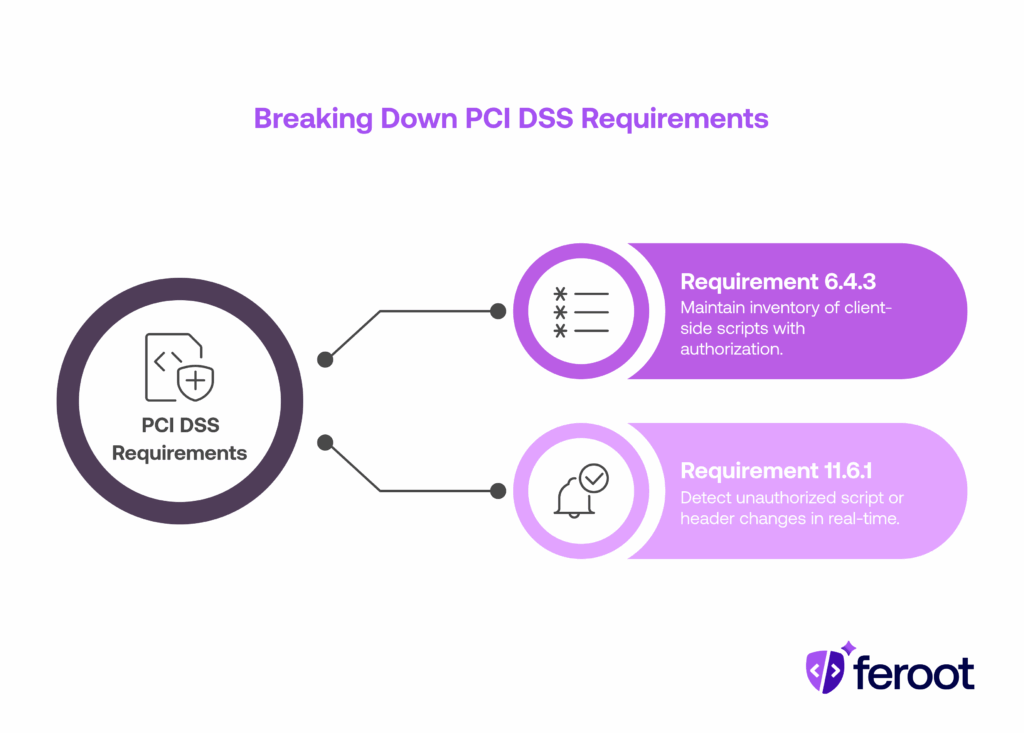

Compliance effort often comes from manual spreadsheets, one-off audits, and error-prone documentation processes. Requirements like PCI DSS 6.4.3 (script inventory and justification) and 11.6.1 (tamper detection and alerts) demand continuous monitoring — something legacy tools and manual processes struggle to provide.

Legacy CSP and manual reviews are inadequate against modern threats such as Magecart attacks and dynamic script injections, increasing risk and operational cost.

What Do PCI DSS Requirements 6.4.3 and 11.6.1 Actually Require?

Requirement 6.4.3

Requires maintaining a documented inventory of all client-side scripts on payment pages, with explicit authorization and use of integrity mechanisms like SRI or CSP.

Requirement 11.6.1

Mandates real‑time or scheduled detection and alerting on any unauthorized changes to scripts or HTTP headers rendering in the browser, reviewed at least weekly or per risk-based analysis.

How Does Feroot PaymentGuard AI Automate These Requirements?

Script Inventory & Authorization Automation

Feroot’s PaymentGuard AI automatically scans payment pages and embedded iframes, discovers all scripts, and creates a live inventory—with business justification and approval workflows built-in.

Real-Time Tamper Detection & Alerts

Feroot’s PaymentGuard AI actively monitors script behavior and HTTP headers in the browser, detecting unauthorized changes instantly and sending alerts via email, SIEM, or dashboards—fulfilling Requirement 11.6.1 fully.

Audit-Ready Compliance Documentation

Feroot’s PaymentGuard AI generates exportable reports containing script inventory, change logs, and compliance status — aligned with QSA expectations and audit timelines.

Zero Dev Implementation

Deployment is trivial: a single line JavaScript tag or CSP header integration. No code rewrites, no dev dependencies. Full functionality live within 24 hours.

Seamless GRC Stack Integration

Fed alerts into SIEMs like Splunk or Datadog, exported compliance documentation into GRC tools like Drata or Vanta, and connected to incident response workflows via APIs.

How Quickly Can Your Team Be Fully Compliant?

Deployment timeline:

- Day 1: Deploy Feroot, discover script inventory, baseline integrity assessment.

- Days 2–3: Tune security policies, enable monitoring and CSP enforcement.

- Within one week: Full compliance with PCI DSS 6.4.3 and 11.6.1, with audit-ready reports and continuous monitoring.

Post-March 31, 2025 deadline compliance remains achievable immediately via fast-track deployment and readiness assessments.

What Real‑World Impact Do Companies See?

Security teams using Feroot’s PaymentGuard AI report up to 95% faster compliance implementation, eliminating manual tracking and audit prep strain. One e-commerce platform cut script monitoring work to minutes with zero engineering involvement.

How Does Feroot Help CISOs Automate Compliance and Reduce Risk?

Feroot’s PaymentGuard AI simplifies PCI DSS 6.4.3 and 11.6.1 into a streamlined compliance operation:

- Client‑side visibility: Monitor script behavior and HTTP headers that traditional tools ignore.

- Continuous compliance: Automated inventory, integrity checks, alerts, and audit logs.

- Operational ease: No development effort, lightweight deployment, fast time to value.

- Risk mitigation: Detect and block e‑skimming and Magecart-style attacks before they breach your payment flow.

- Auditor confidence: Exportable reports designed for QSAs and compliance frameworks.

Feroot’s PaymentGuard AI operationalizes compliance, shifting from checkbox exercises to enforced, visible security across your payment interfaces.

What Are the Hidden Risks of Ignoring Client-Side PCI Compliance?

Many security teams focus heavily on backend infrastructure — databases, API gateways, encryption, WAFs — while underestimating the browser layer where cardholder data input actually occurs. This oversight creates a compliance and breach blind spot.

Why it matters:

- Browser-side code is dynamic and volatile — 3rd-party scripts update without notice and often load from uncontrolled CDNs.

- Magecart and e-skimming groups exploit this surface to silently skim PANs and CVVs without touching the backend.

- Traditional PCI tools don’t inspect the browser — they monitor servers, not real-time user interactions or script behavior.

Business implications:

- Merchants can lose PCI certification after a client-side breach — even if their backend systems are untouched.

- Fines, investigations, and reputational damage often follow invisible browser-side failures.

- Without Requirement 6.4.3 (script justification) and 11.6.1 (tamper detection), the attack surface remains open — and undocumented.

FAQ

How does compliance automation improve audit outcomes?

Automated detection and reporting reduce errors, provide clear audit trails, and minimize manual prep time.

Can I manage multiple requirements like 6.4.3 and 11.6.1 simultaneously?

Yes. Feroot’s unified platform covers both script inventory and tamper detection in one solution.

Is PaymentGuard AI compatible with auditors’ requirements?

Absolutely. Reports are QSA-ready, showing configuration logs, change histories, and compliance evidence.

What if my team isn’t focused on compliance?

Minimal training is needed—dashboard UX is intuitive, and no engineering dependencies exist.

Does Feroot integrate with AWS, CSP tools, or Jira?

Yes. It works with existing security stacks—including GRC tools, SIEMs, CSP enforcement systems, and DevSecOps pipelines.

Conclusion

Feroot PaymentGuard AI turns the burdensome tasks of PCI DSS 6.4.3 and 11.6.1 compliance into automated, continuous security processes—without code changes or developer involvement. CISOs gain real client‑side visibility, robust tamper detection, and audit-ready documentation, while reducing costs and team overhead. Security becomes visible, manageable, and auditable—without home‑grown spreadsheets or painful audits.