Introduction to PCI DSS in Canada

For Canadian businesses that process, store, or transmit credit card information, PCI DSS compliance isn’t optional—it’s mandatory. Yet, many companies misinterpret key requirements or overlook crucial steps, leaving themselves vulnerable to data breaches, fines, and reputational damage. This article explores the most common pitfalls organizations face with PCI DSS in Canada and outlines how to build a more secure, compliant environment.

Understanding PCI DSS in a Canadian Context

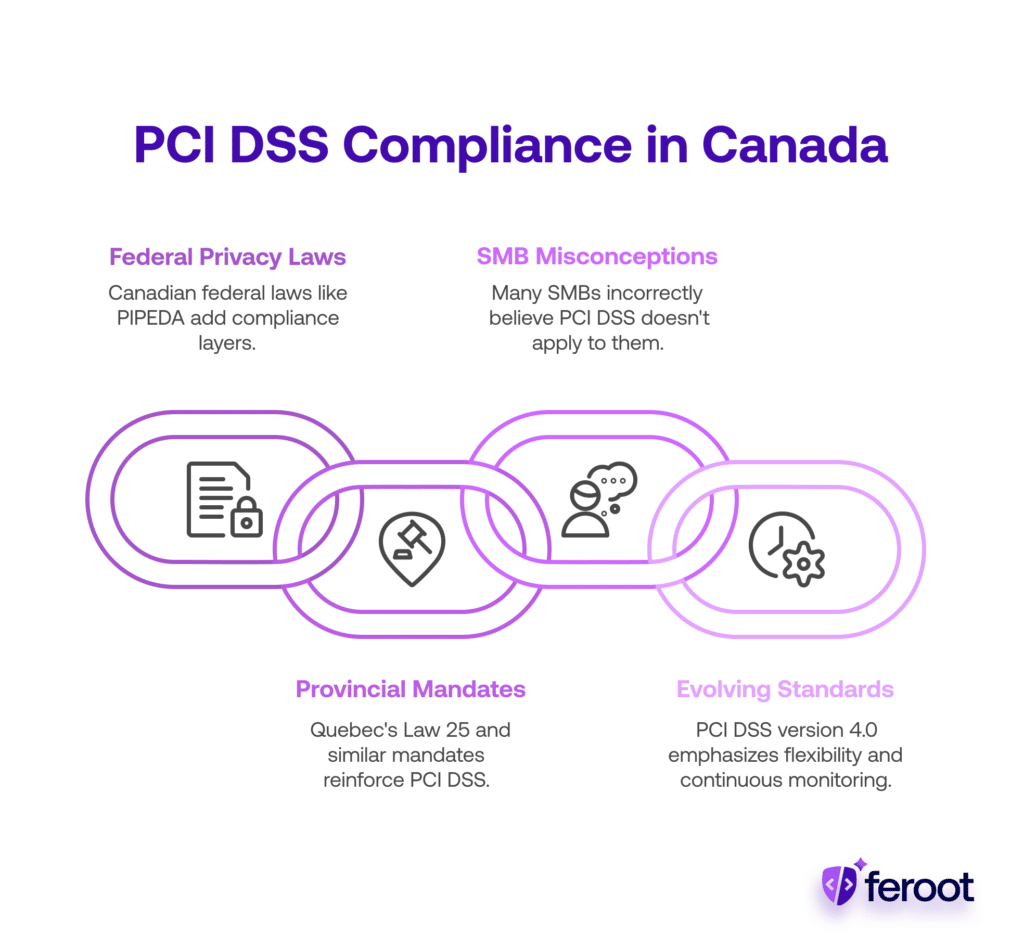

The Payment Card Industry Data Security Standard (PCI DSS) is a global security framework created to safeguard cardholder data. While the standard itself is universal, Canadian businesses often misunderstand how it intersects with local regulations and payment ecosystems.

Key considerations for Canada:

- Canadian federal privacy laws (e.g., PIPEDA) add another layer of compliance.

- Quebec’s Law 25 and other provincial mandates may reinforce PCI DSS controls.

- Many Canadian SMBs incorrectly believe PCI DSS only applies to large enterprises.

It’s also important to recognize that PCI DSS evolves—version 4.0 introduced new emphasis on flexibility, outcome-based controls, and continuous monitoring. Businesses must stay agile and adapt their security practices accordingly.

Why PCI DSS Compliance Still Matters in 2025

Despite technological advancements, Canada remains a high-value target for cybercriminals due to the widespread use of electronic payments. According to Interac, over 80% of transactions in Canada are now contactless or online—raising the stakes for payment data protection.

Threat actors now focus on complex supply chain vulnerabilities and real-time skimming techniques, which often bypass traditional defenses. Staying compliant also helps future-proof your business against tightening regulations both domestically and internationally.

Key Reasons to Prioritize Compliance:

- Avoid penalties from acquiring banks and card brands.

- Prevent costly data breaches that damage customer trust.

- Ensure readiness for increasing regulatory scrutiny.

Addressing PCI DSS 4.0: What’s Changed?

With the rollout of PCI DSS version 4.0, Canadian businesses must navigate a more dynamic compliance landscape. The updated framework introduces customized validation, expanded multi-factor authentication requirements, and a stronger emphasis on client-side script management.

These changes require organizations to adopt more flexible, risk-based approaches to security—especially for ecommerce and SaaS environments. Businesses should begin transitioning early, as PCI DSS v3.2.1 will be retired by March 2025.

Tip: Start by identifying gaps between your current controls and the new version’s requirements. Use solutions like PageGuard AI to meet the new mandates on script monitoring with ease.

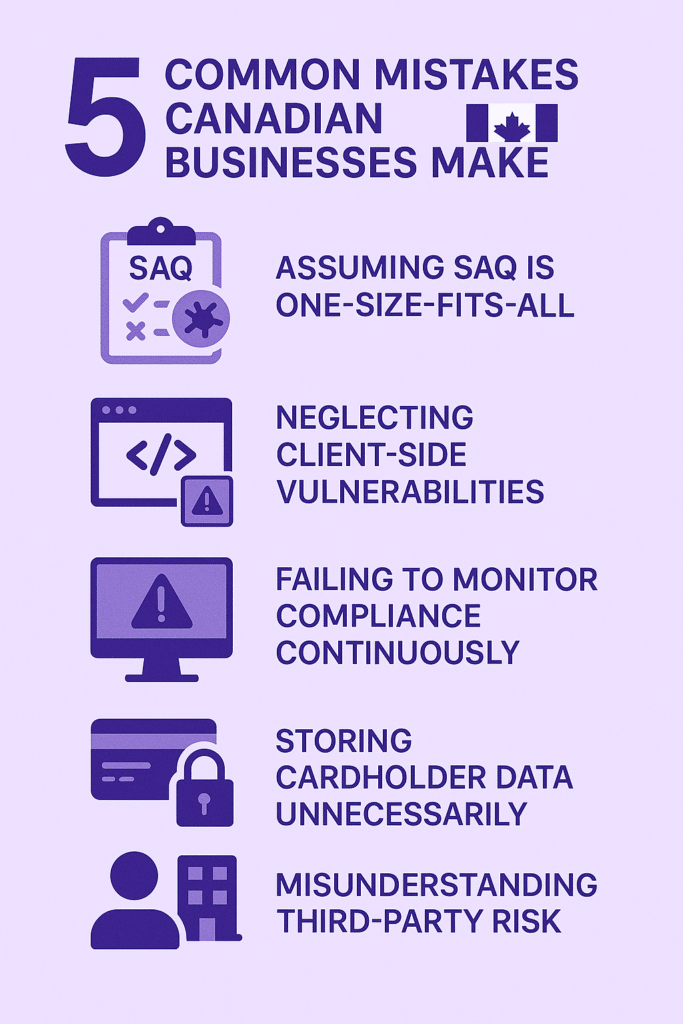

5 Common Mistakes Canadian Businesses Make

- Assuming SAQ Is One-Size-Fits-All: Many businesses complete the wrong Self-Assessment Questionnaire (SAQ), leading to non-compliance. The correct SAQ depends on how you process cardholder data (e.g., virtual terminals, POS, or ecommerce). This misstep often leads to gaps in documentation and security practices, which can be flagged during audits.

- Neglecting Client-Side Vulnerabilities: A major blind spot is the client-side, where JavaScript code can be hijacked through third-party scripts. This is often overlooked in PCI risk assessments. Without continuous monitoring of the front end, businesses may be unaware of script changes that expose user data.

- Failing to Monitor Compliance Continuously: PCI DSS is not a “check-the-box” activity. Businesses must track compliance all year—not just before audits. Tools like file integrity monitoring and event logging are essential. Lack of real-time visibility can result in undetected breaches or delayed incident responses, increasing liability.

- Storing Cardholder Data Unnecessarily: Retention of sensitive data is a major risk. Many organizations mistakenly store CVVs or full PANs, which violates PCI DSS rules. Even encrypted data can be a target if retention policies aren’t strictly followed and enforced.

- Misunderstanding Third-Party Risk: If you’re using third-party service providers (like payment gateways or cloud platforms), you’re still responsible for ensuring their compliance too. Shared responsibility does not mean shared accountability—your brand is still on the line if vendors fail.

Unique PCI DSS Challenges in Canada

- Data Residency and Sovereignty: Some Canadian businesses struggle to understand how PCI DSS overlaps with domestic privacy rules, especially in regulated industries like healthcare, education, or government contracting. Data residency laws can impact how and where cardholder information is stored, which affects compliance scope and vendor selection.

- Bilingual Compliance: Documentation and staff training must be bilingual (English & French) for Quebec-based operations—an often-overlooked requirement during assessments. Neglecting this not only risks compliance but may also lead to employee misunderstandings or poor adherence to security policies.

- Cross-Border Processing: If you’re working with U.S.-based payment processors, be aware of added exposure under both PCI DSS and U.S. data breach laws. This cross-jurisdictional complexity requires additional due diligence when evaluating cloud services and data flow models.

Best Practices to Strengthen Compliance

- Use the correct SAQ: Align with your transaction and storage model. Reassess annually or when systems change to ensure alignment.

- Deploy continuous monitoring tools: Especially those that track changes to scripts, DNS, or storage configurations. Automation can help reduce the burden on internal teams and catch issues proactively.

- Train employees regularly: Focus on phishing, internal data handling, and recognizing shadow IT. Consider role-specific training modules for IT, customer service, and compliance staff.

- Limit scope: Use tokenization and end-to-end encryption to minimize systems that handle sensitive data. Reducing scope not only cuts compliance costs but also limits breach impact.

- Document everything: Maintain clear audit trails, vendor compliance documentation, and incident response plans. Comprehensive records are critical during forensic investigations and regulator inquiries.

Enhancing Client-Side PCI Compliance with PaymentGuard AI

Client-side vulnerabilities remain one of the most underestimated risks in PCI DSS compliance—particularly in Canada, where ecommerce and digital payments continue to rise. While server-side defenses remain critical, many modern breaches—like Magecart-style attacks and JavaScript skimming—occur directly in the end user’s browser, often going undetected until significant damage has been done. That’s where PaymentGuard AI by Feroot provides a vital layer of protection.

PaymentGuard AI is a specialized, AI-powered solution built to secure payment data at the web application layer. It continuously monitors and defends against unauthorized third-party scripts, malicious injections, and data exfiltration attempts targeting sensitive form fields like credit card numbers, CVVs, and expiration dates.

Tailored specifically for PCI DSS 4.0 compliance, PaymentGuard AI enables businesses to meet client-side monitoring requirements without adding friction to the development pipeline. Its intelligent automation, behavioral analytics, and real-time alerts ensure both compliance and security across checkout flows—helping Canadian organizations safeguard customer trust while reducing compliance risks.

Conclusion

PCI DSS compliance in Canada is not just a checkbox—it’s a strategic necessity. From choosing the right SAQ to securing your client-side scripts, every detail matters. By avoiding common missteps and implementing continuous monitoring, businesses can reduce both compliance costs and breach risk. Staying proactive with compliance doesn’t just protect your operations—it also sends a message to customers and partners that your organization takes data privacy seriously. Regular reviews, adaptive security practices, and solutions like PaymentGuard AI can help you stay ahead of emerging threats.