TL;DR

- PCI DSS 6.4.3 and 11.6.1 demand visibility into JavaScript changes and real-time script monitoring on payment pages.

- Hospitality brands face unique risks from third-party scripts, booking engines, loyalty portals, and embedded marketing pixels.

- Manual monitoring and legacy GRC tools can’t keep pace with modern client-side threats.

- Feroot PaymentGuard AI automates detection, reporting, and compliance with PCI DSS 4.0 requirements—without developer overhead.

- Security teams save time, reduce audit stress, and strengthen guest trust by eliminating blind spots in the browser.

Why are PCI DSS 6.4.3 and 11.6.1 so challenging for hospitality brands?

PCI DSS 6.4.3 requires organizations to maintain integrity controls over all JavaScript running on payment pages, while 11.6.1 requires continuous monitoring and alerting for script changes. For hospitality brands, compliance is harder than in other industries because:

- Payment workflows span multiple systems: booking engines, property management systems (PMS), and loyalty portals.

- Hospitality websites often integrate dozens of marketing and analytics scripts—many managed by third parties.

- Developers may not control scripts injected by vendors or affiliates, making inventory and change detection difficult.

The result: Security teams struggle with fragmented visibility, manual evidence collection, and constant alerts during audits.

What client-side risks are unique to hotels, resorts, and travel portals?

Hospitality websites and apps handle sensitive data at multiple touchpoints beyond checkout:

- Booking Engines: Guests enter credit card details, passport numbers, and addresses.

- Loyalty Programs: Sensitive personally identifiable information (PII) like birthdays and travel history.

- Marketing Scripts: Third-party ad pixels and trackers embedded to measure campaigns.

- Partner Integrations: Travel portals and OTAs (Online Travel Agencies) inject scripts the brand doesn’t control.

These client-side risks often go unmonitored, yet attackers target them with Magecart-style skimming attacks and malicious script injections.

How does Feroot PaymentGuard AI simplify compliance workflows?

Feroot’s PaymentGuard AI is purpose-built to automate PCI DSS 6.4.3 and 11.6.1 compliance for hospitality brands.

Key capabilities include:

- Automated Script Inventory: Maintains a living catalog of all JavaScript running on payment pages.

- Change Detection & Alerting: Identifies unauthorized modifications in real time, satisfying 11.6.1.

- Integrity Controls: Monitors and enforces policies for script behavior, covering 6.4.3 requirements.

- Audit-Ready Reporting: Generates evidence that maps directly to PCI DSS 4.0 controls, reducing audit prep by up to 80%.

- Zero Dev Effort: Deploys without code changes or ongoing engineering support.

For CISOs and compliance leaders, this means less time spent chasing evidence and more confidence during assessments.

What outcomes can CISOs and compliance leaders expect?

Hospitality brands that deploy Feroot PaymentGuard AI see measurable compliance and security outcomes:

- Audit efficiency: Weeks of manual evidence collection reduced to minutes.

- Risk reduction: Eliminate blind spots in third-party and client-side scripts.

- Stronger guest trust: Protect sensitive booking and payment data from browser-side threats.

- Faster compliance cycles: Move from audit readiness in months to weeks.

Hospitality security leaders can stop firefighting and start focusing on delivering secure guest experiences.

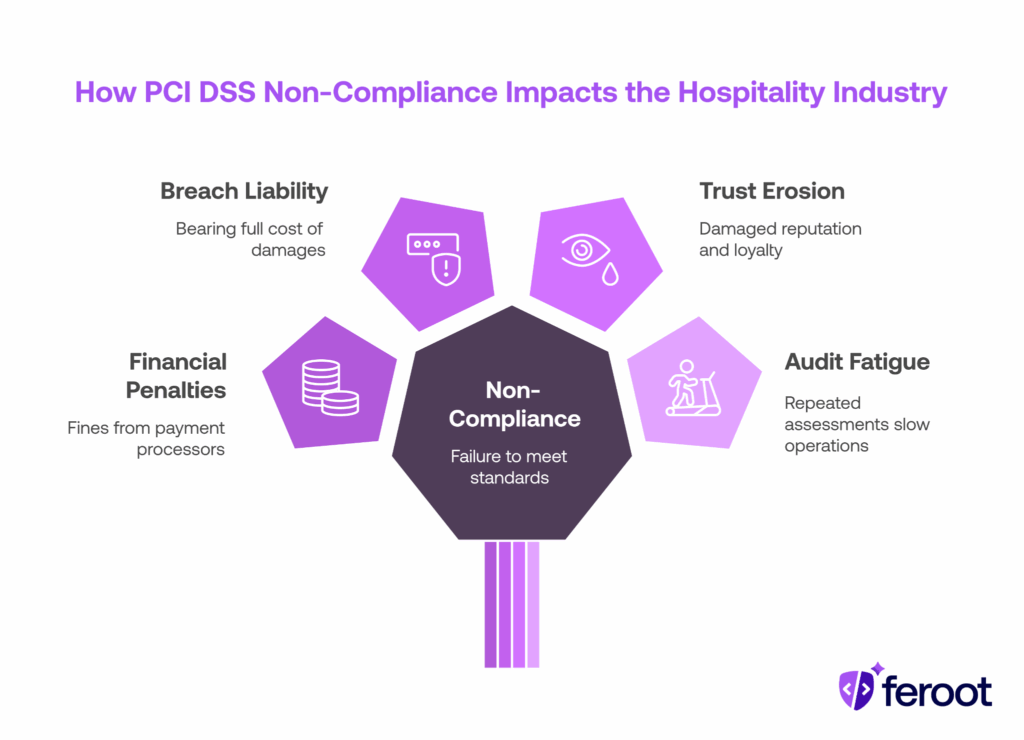

What happens if hospitality brands fail PCI DSS 6.4.3 and 11.6.1 compliance?

Non-compliance isn’t just a technical gap—it creates real business risk for hospitality organizations.

Key impacts include:

- Hefty fines and penalties: Payment processors can impose financial penalties, and card brands may revoke the ability to process payments.

- Breach liability: If a card-skimming attack occurs and you’re out of compliance, your brand may bear the full cost of damages.

- Guest trust erosion: A single incident of leaked payment or booking data can permanently damage reputation and loyalty.

- Audit fatigue: Failure to comply often leads to repeated assessments, slowing down operations across properties.

Hospitality CISOs and compliance leaders can’t afford to let these requirements slide. Automating compliance with Feroot PaymentGuard AI transforms this from a burden into a strategic advantage.

How does Feroot help CISOs automate compliance and reduce risk?

Feroot uniquely addresses the client-side gap that PCI DSS 6.4.3 and 11.6.1 now mandate visibility into. Traditional compliance platforms monitor servers and networks, but Feroot PaymentGuard AI protects the browser—where guest data is actually entered.

Why this matters:

- Many card skimming breaches happen at the browser layer, not the backend.

- Hospitality brands rely heavily on third-party scripts they don’t directly control.

- Regulators now expect visibility into client-side risks.

What Feroot does:

- Enforces integrity checks on scripts loading at checkout.

- Detects unauthorized changes that could enable data theft.

- Produces audit-ready logs aligned to PCI DSS 4.0 evidence requirements.

- Integrates into existing compliance and DevSecOps workflows with minimal friction.

For hospitality CISOs, this means faster compliance cycles, reduced risk exposure, and less time lost to manual monitoring.

FAQ

How does compliance automation improve PCI DSS audit outcomes?

By automating script monitoring and reporting, PaymentGuard AI reduces errors and ensures evidence is always up to date, helping audits move faster with fewer findings.

Can hospitality brands manage multiple properties and frameworks at once?

Yes. Feroot PaymentGuard AI scales across multiple domains and properties, with evidence mapping that supports PCI DSS 4.0 and other frameworks like SOC 2.

Is Feroot PaymentGuard AI auditor-approved?

Feroot’s reporting maps directly to PCI DSS 6.4.3 and 11.6.1 controls, giving auditors the clarity they expect.

What if our security team isn’t compliance-focused?

Feroot PaymentGuard AI is designed for lean teams—no need for dedicated compliance engineers.

Does Feroot PaymentGuard AI integrate with our existing systems?

Yes. It works alongside hospitality booking engines, PMS systems, and standard SIEM/DevSecOps workflows.

Conclusion

For hospitality brands, PCI DSS 6.4.3 and 11.6.1 compliance is no longer optional—it’s a critical safeguard against client-side payment risks. Manual monitoring and spreadsheets can’t keep up with complex guest-facing systems and third-party scripts.

Feroot PaymentGuard AI eliminates blind spots, automates compliance workflows, and ensures faster, smoother audits—so CISOs and security leaders can focus on what matters: protecting guests and building trust.