Understanding the Digital Operational Resilience Act (DORA)

The Digital Operational Resilience Act (DORA) is a critical regulatory framework introduced by the European Union to enhance the digital resilience of the financial sector. It mandates a uniform set of standards for ICT risk management frameworks, digital resilience capabilities, and third-party service oversight. Enforceable by European supervisory authorities, DORA ensures that all covered entities can respond to and recover from major ICT-related incidents, including cyber attacks.

By establishing regulatory technical standards (RTS), DORA drives consistency across the EU’s digital finance ecosystem. The act also formalizes the obligation to conduct regular reviews, implement continuous monitoring, and undergo threat-led penetration testing.

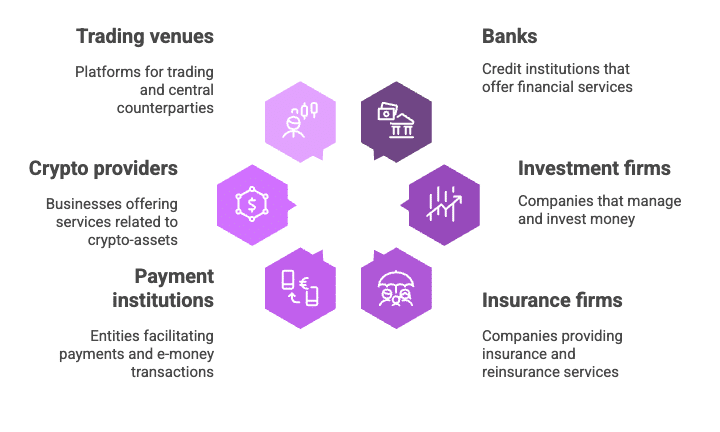

Key Entities Required to Comply with DORA

DORA applies to a wide range of entities that play critical roles in the EU financial ecosystem, including:

- Credit institutions (banks)

- Investment firms

- Insurance and reinsurance undertakings

- Payment institutions and e-money institutions

- Crypto-asset service providers

- Trading venues and central counterparties

Beyond these, the scope extends to critical ICT third parties, including cloud service and software providers that deliver ICT third-party services essential to financial operations.

Understanding this broad DORA regulation scope is essential for identifying whether your business—or your partners—must implement compliance strategies. Any entity performing a critical or important function or handling critical third parties in digital financial services must assess exposure and responsibilities.

Impact of DORA on Financial Services and Technology Firms

For financial services and tech firms, DORA is a transformation mandate. Organizations must redesign operations to align with DORA regulatory requirements and compliance under DORA. This includes overhauling systems for ICT risk management, instituting regularly tested incident detection and response systems, and ensuring digital operational resilience testing is both effective and auditable.

Technology firms, especially those classified as ICT providers under DORA, will be subject to scrutiny by the European Commission and supervisory bodies. This includes mandatory disclosure of major ICT-related incidents, critical ICT third-party dependencies, and mechanisms to continuously monitor risk.

Companies must also understand how DORA interacts with other EU financial regulations, such as GDPR and MiFID II, creating an integrated governance challenge for legal, compliance, and IT departments.

Compliance Strategies for Businesses Under DORA

Implementing DORA compliance should begin with a comprehensive audit of digital operations. Effective strategies include:

- Mapping ICT risks and dependencies using structured frameworks to identify gaps in resilience.

- Implementing incident response frameworks that address critical ICT third-party risk and define protocols to respond to and recover swiftly.

- Reviewing and renegotiating contracts with ICT third-party service providers to ensure DORA-aligned obligations.

- Establishing continuous monitoring processes for infrastructure and supply chains.

- Conducting threat-led penetration testing and resilience testing as required by DORA enforcement mechanisms.

Firms must also prepare for ongoing regulatory reviews and maintain documentation to demonstrate DORA compliance checklist completion during audits.

Preparing Your Organization for DORA

Organizations should not wait until the January 2025 deadline. Proactive steps include:

- Assigning ownership of digital resilience frameworks to dedicated governance teams.

- Running regular tests of business continuity and incident response plans.

- Creating cross-functional task forces that involve IT, legal, compliance, and vendor management.

- Ensuring major ICT-related incidents are flagged, escalated, and recorded according to EU digital resilience standards.

- Building audit trails for internal reviews and European supervisory authorities.

Investing in tooling for ICT risk management, real-time alerting, and regulatory reporting will ease future obligations.

The Future of DORA and Its Implications

DORA represents not just a compliance obligation but a shift in how organizations approach digital resilience. Over time, this regulatory framework may:

- Extend beyond the financial sector, becoming a model for operational resilience globally.

- Encourage firms to build integrated compliance platforms that cover privacy, cybersecurity, and operational risk together.

- Foster partnerships across industries as organizations share methods for critical ICT third-party oversight.

- Drive standardization in how ICT third-party risk and critical third parties are classified and managed.

The increasing focus on operational resilience in the EU is pushing firms to rethink not only their ICT obligations but also the core of their business continuity strategies.

Conclusion & Next Steps

The Digital Operational Resilience Act is a game-changer for financial and ICT organizations operating in or with the EU. It goes beyond standard cybersecurity to require a full-scale operational and governance upgrade. Whether you’re a financial institution or a service provider supporting one, DORA mandates your role in securing the digital financial supply chain.

Start your DORA readiness journey now!

Explore how Feroot Security can help streamline your DORA compliance with AI-powered tools that monitor, detect, and mitigate digital risks—keeping your business secure, resilient, and regulation-ready.