Introduction

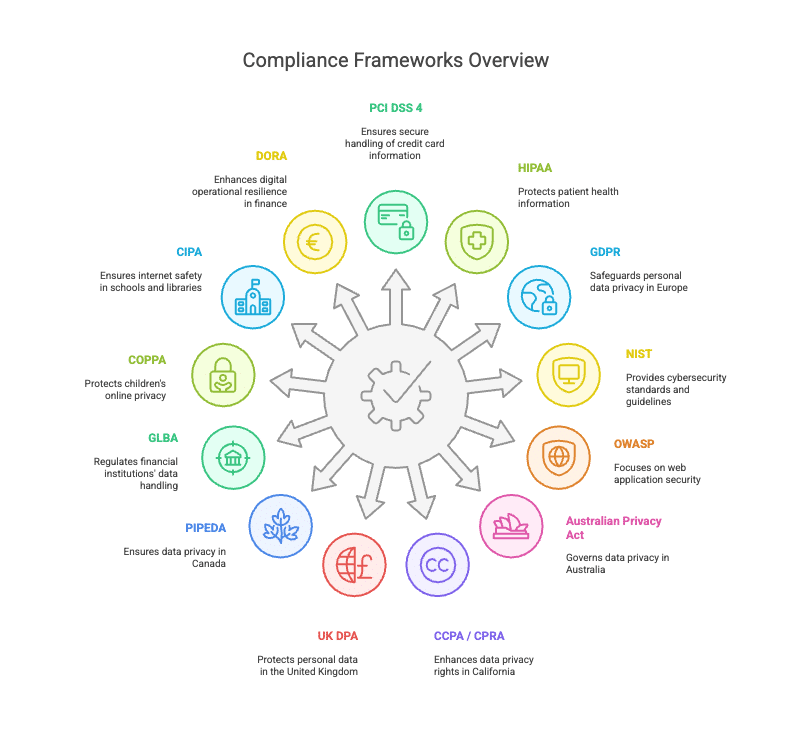

For modern digital businesses, compliance isn’t just a legal requirement—it’s a trust-building and security-enabling mechanism. Compliance frameworks like PCI DSS 4, HIPAA, GDPR, and NIST establish the technical and procedural standards organizations must meet to protect sensitive data, avoid regulatory penalties, and qualify for cyber insurance.

By adopting these frameworks, companies can ensure data protection best practices for websites, support compliance automation for web applications, and achieve website compliance for global privacy laws. As we explore each major framework, we’ll show how they contribute to a secure, resilient, and trustworthy digital presence.

PCI DSS 4 Compliance for Websites

The Payment Card Industry Data Security Standard version 4.0 is essential for any business handling online transactions. It introduces enhanced requirements like third-party script monitoring for PCI DSS 4, which protects against threats such as Magecart attacks and formjacking.

Key components include browser-side integrity checks, such as Requirement 6.4.3, which mandates that organizations maintain an inventory of all scripts loaded in the payment page and ensure each is authorized. Additionally, Requirement 11.6.1 requires the detection and alerting of unauthorized script behavior in real time. These updates reflect the growing need to secure the client-side attack surface, where most e-commerce breaches now occur due to the rise in supply chain attacks and third-party risk.

A critical part of achieving PCI DSS 4.0 compliance is completing the appropriate Self-Assessment Questionnaire (SAQ). The SAQ is a validation tool designed for merchants and service providers who are not required to submit a Report on Compliance (ROC).

Depending on how your business processes payments—via web forms, redirection, iFrames, or third-party checkout systems—you may be required to complete SAQ A, SAQ A-EP, SAQ D, or others. For example, businesses hosting their own payment pages with custom JavaScript typically fall under SAQ A-EP, which requires stricter controls, including the very client-side monitoring practices outlined in 6.4.3 and 11.6.1.

HIPAA Compliance for Healthcare Data

For organizations dealing with protected health information (PHI), HIPAA compliance for healthcare data is critical. It applies to hospitals, telehealth platforms, and even marketing teams that use trackers on public-facing healthcare websites.

To meet HIPAA requirements, businesses must limit PHI exposure through technical safeguards like secure web forms, encryption, and vendor controls. Websites must avoid leaking health data to analytics tools without proper authorization. These measures help organizations prevent regulatory violations and build trust in sensitive health environments.

GDPR Website Compliance Requirements

The General Data Protection Regulation (GDPR) defines strict rules for collecting, processing, and storing the personal data of EU residents. GDPR website compliance requirements include transparent consent management, the right to data access and deletion, and proper legal bases for processing user information.

Failure to comply can lead to massive fines and loss of customer trust. On the other hand, meeting these obligations enhances credibility and aligns your website with enhancing website trust through compliance principles that modern users expect.

OWASP Standards for Secure Development

Security starts with code. The OWASP standards for secure development offer developers a globally accepted checklist of vulnerabilities to avoid—including cross-site scripting, injection flaws, and access misconfigurations.

Integrating OWASP into your CI/CD pipelines ensures secure application design and reduces remediation costs. For dev teams building new web apps, this standard supports compliance automation for web applications and lays the groundwork for long-term resilience.

Australian Privacy Act Website Obligations

In Australia, the Privacy Act 1988 outlines 13 Australian Privacy Principles (APPs) that regulate how businesses collect and handle user data. These include access rights, collection limitations, cross-border disclosure rules, and mandatory breach notifications.

Fulfilling Australian Privacy Act website obligations shows respect for local data rights and enables smoother partnerships with Australian entities, who increasingly require third-party vendors to meet national privacy standards.

CCPA/CPRA Data Compliance Checklist

The California Consumer Privacy Act (CCPA) and its amendment, the California Privacy Rights Act (CPRA), empower users with visibility and control over their personal information. Organizations must implement data inventories, cookie disclosures, opt-out mechanisms, and user access systems.

Maintaining a CCPA/CPRA data compliance checklist ensures U.S. state-level privacy compliance and demonstrates your readiness for future federal privacy laws that may mirror or build upon CPRA.

UK DPA Data Protection Rules

Post-Brexit, the UK Data Protection Act 2018 governs personal data handling in the United Kingdom. Though it closely mirrors GDPR, it includes UK-specific enforcement structures and oversight bodies.

Following UK DPA data protection rules is essential for any business serving UK residents and is often required by contract when entering into data processing agreements with British partners.

PIPEDA Requirements for Canadian Sites

In Canada, PIPEDA (Personal Information Protection and Electronic Documents Act) defines the privacy expectations for private-sector businesses. Organizations must ensure user consent, data accuracy, and secure storage.

Meeting PIPEDA requirements for Canadian sites enhances compliance in a region known for stringent regulator oversight and supports website compliance for global privacy laws across North America.

GLBA Safeguards for Financial Institutions

The Gramm-Leach-Bliley Act (GLBA) requires U.S. financial institutions to implement written security policies, restrict data access, and regularly assess internal risks. These rules are non-negotiable for any company managing consumer financial records.

Ensuring GLBA safeguards for financial institutions improves operational transparency and strengthens compliance during internal and regulatory audits.

COPPA Compliance for Children’s Websites

The Children’s Online Privacy Protection Act (COPPA) governs digital services directed at users under 13. COPPA compliance for children’s websites requires verified parental consent, age-appropriate language, and strict limits on advertising and behavioral tracking.

Educational and entertainment platforms targeting minors must integrate compliance from the ground up to avoid enforcement actions and protect vulnerable users.

CIPA School Internet Safety Rules

The Children’s Internet Protection Act (CIPA) applies to U.S. K–12 schools and libraries receiving federal funding. It mandates online safety policies, content filters, and monitoring systems to prevent students from accessing harmful or inappropriate content.

Organizations that meet CIPA school internet safety rules demonstrate a strong commitment to safeguarding minors in digital environments.

DORA Risk Compliance in Finance

The Digital Operational Resilience Act (DORA) is a new EU regulation focused on ICT risk in the financial sector. It requires firms to establish cyber resilience programs, conduct third-party risk assessments, and implement comprehensive incident reporting protocols.

Achieving DORA ICT risk compliance in finance strengthens operational continuity and ensures financial institutions can withstand growing digital threats.

NIST Cybersecurity Risk Management Guide

The NIST Cybersecurity Framework (CSF) is widely adopted across industries for structuring security controls around five core functions: Identify, Protect, Detect, Respond, and Recover.

Using the NIST cybersecurity risk management guide, organizations can tailor their security programs to their size and industry. It’s a versatile framework often cited in cyber insurance questionnaires and compliance audits, making it central to improving cyber insurance eligibility.

How Frameworks Reduce Cybersecurity Risks

Whether it’s OWASP minimizing app vulnerabilities, PCI DSS blocking skimming scripts, or GDPR limiting data exposure, each framework helps reduce risk across the digital stack. The shared goal is to enable visibility, control, and governance over data in motion and at rest. By reducing human error, enforcing access controls, and standardizing breach response, frameworks help organizations move from reactive fixes to proactive protection.

Incorporating frameworks into your development and IT operations improves both security and efficiency—delivering scalable, documented controls that strengthen your overall cyber defense.

Why Compliance Improves Cyber Insurance Eligibility

As insurers evolve their underwriting standards, compliance plays a larger role in determining coverage, limits, and premiums. Providers now look for structured security frameworks, documented assessments, and incident readiness. Organizations demonstrating compliance with PCI DSS 4, NIST, and GDPR gain a competitive advantage in risk evaluations.

This growing cybersecurity compliance and insurance link means that companies with strong governance are not only safer—they’re more insurable. Compliance becomes a business enabler, reducing downtime, legal costs, and even insurance premiums.

Conclusion: Building Trust Through Compliance

From protecting health records to regulating children’s data, compliance frameworks aren’t just rules—they’re systems of trust. When you align with these standards, you show your users, regulators, and partners that security is a core value, not an afterthought.

Whether you’re applying for cyber insurance, expanding into new regions, or scaling your web infrastructure, frameworks like PCI DSS 4, HIPAA, GDPR, and NIST provide the structure and assurance your organization needs.

Explore how Feroot Security helps you implement, monitor, and automate compliance across all these frameworks. Request a demo today.