Most organizations begin their PCI DSS planning with what’s easiest to define: the Qualified Security Assessor (QSA) fee. As the process unfolds, other costs come into view, from mapping data flows to preparing evidence. Seeing the full picture early helps teams plan with confidence.

What you’ll learn this article

- What PCI really costs: The full picture beyond the QSA fee, including preparation, visibility, and year-round compliance work.

- What drives your number: How scope, security maturity, and merchant level affect effort, and how segmentation can shrink it.

- What’s new in 4.0.1: Client-side controls (Reqs 6.4.3 and 11.6.1), why manual script tracking falls short, and how automation changes the game.

- How to budget smart: A practical plan across audit, internal labor, tooling, and remediation, plus tactics to cut QSA time and avoid surprises.

Seeing the Full PCI Cost Picture

What we’ve learned from working with organizations across industries is that most of the cost sits below the surface. Preparing evidence, maintaining visibility, and staying compliant throughout the year can add up to sixty or seventy percent of the total budget.

With PCI DSS 4.0.1, there’s also a new and unexpected cost factor: client-side security. The latest requirements, 6.4.3 and 11.6.1, are introducing fresh challenges for teams that have passed audits for years. Let’s walk through what a realistic budget looks like and where organizations are finding the biggest surprises.

Cost overview by merchant level

Every organization’s PCI DSS budget looks a little different, but the main costs follow predictable patterns based on merchant level and environment complexity.

| Merchant Level | Year 1 Total | Annual Ongoing | Key Drivers |

| Level 1 (6M+ transactions) | $245,000–$600,000 | $160,000–$350,000 | QSA RoC ($80K–$200K), internal labor ($40K–$100K), technology improvements ($65K–$200K) |

| Level 2 (1M–6M transactions) | $30,000–$120,000 | $20,000–$70,000 | SAQ or RoC depending on acquirer |

| Level 3–4 (<1M transactions) | $5,000–$25,000 | $4,000–$15,000 | SAQ and quarterly scans |

What shapes your actual cost

Scope complexity

Scope is where cost begins. A small retailer using a single hosted checkout and a few third-party payment scripts may only have one environment in scope. A global enterprise with multiple brands, regional sites, and customized checkout experiences might face hundreds of scripts across dozens of domains, all handling customer data.

When systems are tightly segmented and clearly documented, the QSA review stays focused. When scripts and data flows overlap, scope expands and so does the time and cost to reach compliance.

Security maturity

Mature security programs already monitor systems, track scripts, and generate compliance evidence automatically. For them, audits are confirmation, not discovery. Others still rely on manual checks, scrolling through browser consoles, taking screenshots, and tracking changes in spreadsheets.

For organizations managing thousands of web pages, that approach quickly becomes unmanageable. Automated visibility across client-side scripts not only saves time but ensures accuracy when every update counts.

Merchant level requirements

Level 1 merchants require a full Report on Compliance, penetration testing, and quarterly scans. Smaller merchants often use Self-Assessment Questionnaires, though acquirers may still require external validation.

We’ve seen that when organizations maintain continuous visibility throughout the year, their audits take less time and involve less back-and-forth. It’s not just about saving money, but reducing stress for everyone involved.

The major cost components

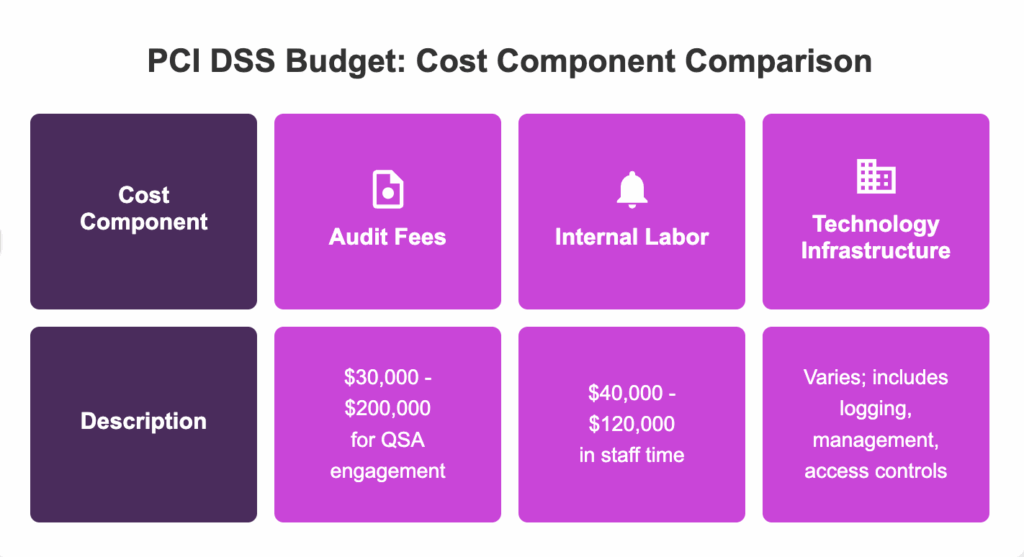

When planning your PCI DSS budget, it helps to think in four main categories:

- Audit fees

- Internal labor

- Technology infrastructure

- Remediation

Direct audit fees

A QSA engagement usually ranges from $30,000 to $200,000 depending on your level and scope. Quarterly vulnerability scans typically cost $2,000 to $8,000 per year, and Level 1 merchants also invest in annual penetration testing that can range from $20,000 to $60,000.

Internal labor

Preparing for the audit takes time from several teams. Security staff may spend 120 to 300 hours collecting evidence, IT teams contribute 80 to 150 hours supporting tests and fixes, and managers often spend another 40 to 80 hours in interviews and sign-offs. Altogether, that can represent $40,000 to $120,000 in annual staff time for large merchants.

Technology infrastructure

The cost of tools varies, but most organizations find they need stronger logging, configuration management, and access controls. With PCI DSS 4.0, client-side security monitoring has also become essential.

In our experience, the organizations that budget for both people and technology early on feel more confident when the audit begins.

The PCI DSS 4.0 cost increase: Client-side security

The New Requirements

Requirements 6.4.3 and 11.6.1 are the newest additions to PCI DSS 4.0, and they are changing how organizations think about web application security. These requirements focus on monitoring scripts running in users’ browsers and detecting any unauthorized changes. For many teams that have been compliant for years, this is the first time the client-side environment has been part of the audit conversation.

Why This Is Expensive

Modern payment pages are complex. A single checkout experience can load 15 to 40 scripts from various sources. Some are intentional, like analytics or payment processors, while others appear through marketing tags or third-party widgets.

To comply with 6.4.3 and 11.6.1, organizations must:

- Inventory every script running on the page

- Determine which scripts are authorized

- Monitor them continuously for changes or tampering

- Provide validation evidence to the QSA

The challenge is that most organizations do not have these capabilities built in. When we analyze client websites, it’s common to find 20 or more scripts running on a payment page, with several unknown or untracked.

The Manual Approach Cost

Some organizations try to manage script inventory by hand. It sounds reasonable at first, until scale enters the picture. A single website might take 40 to 80 hours to inventory and classify scripts manually. Add a dozen web applications or a large payment ecosystem, and that effort multiplies fast.

Rechecking scripts each quarter can add another 30 to 40 hours, and documenting findings for the QSA often takes a full week on its own. Manual tracking scales linearly while the web keeps changing. Automation is the only practical way to stay current.

At standard internal labor rates, that often adds up to $15,000 to $25,000 per year, and still doesn’t provide real-time visibility. Manual checks only show what the page looked like that day. They cannot detect tampering that happens between reviews, which is exactly what Requirement 11.6.1 was designed to catch.

We’ve seen organizations invest months into spreadsheets and screenshots, only to be told by QSAs that their documentation doesn’t demonstrate continuous monitoring.

The Automated Approach

Automated platforms for client-side security take on the work of discovery, behavioral monitoring, and tamper detection. They identify every script running on a site, flag unknown activity, and automatically generate audit-ready evidence.

Most compliance automation and client-side monitoring platforms sit in the mid five-figure range annually, depending on the size of your environment and feature set.

The benefit extends beyond cost. Automated detection protects customers from real-time threats that manual processes can’t catch. In our experience, these investments often break even or become cost-positive within the first year.

Real-World Example

A Level 2 merchant we worked with managed about 25 scripts across their web checkout flow. Their initial manual tracking effort took more than 200 hours across three departments. After implementing automated script monitoring, their evidence generation became continuous and required less than 20 hours per quarter. The total savings reached nearly $30,000 in the first year, while the QSA’s validation time was cut in half.

Why Organizations Struggle Here

The main challenge is visibility. You can’t monitor what you can’t see. Client-side environments are dynamic, and third-party scripts often load additional code from other vendors. Changes can happen silently between quarterly reviews, leaving a three-month window where tampering could go unnoticed.

Budget Impact

For budgeting purposes, we recommend:

- Level 1 merchants: Allocate $40,000–$60,000 annually for client-side security monitoring

- Level 2 merchants: Plan for $20,000–$40,000

- Levels 3–4: $10,000–$20,000 depending on website complexity

QSAs are increasingly flagging manual methods as insufficient, so it’s wise to implement automated monitoring at least six months before your next audit. This allows time to generate consistent evidence and demonstrate operational effectiveness.

Other hidden costs

Beyond client-side security, several other hidden costs tend to appear once an organization begins preparing for PCI DSS 4.0.

Evidence preparation

QSAs validate controls across all twelve PCI requirements, including access control logs, system configurations, change management records, and vulnerability scans. Organizations without a centralized evidence management process often spend weeks gathering documents during the audit period.

Technology gaps

Common missing components include log aggregation, file integrity monitoring, multi-factor authentication, and vulnerability management tools. Each of these gaps can add $5,000 to $50,000 depending on the organization’s size and existing tools.

Scope creep

New payment channels, cloud migrations, or mergers often expand the environment that needs to be assessed. It’s smart to budget for about 10 to 15 percent scope growth each year as systems evolve.

The more consistently teams maintain documentation and visibility throughout the year, the less disruptive these extra costs become.

How to reduce PCI DSS audit costs

There are practical ways to make PCI DSS compliance more manageable and less costly over time.

Invest in continuous evidence generation

QSA time is directly tied to how quickly they can validate evidence. When evidence is automated and ready to review, audits move faster and cost less. We’ve seen organizations cut QSA validation time in half by maintaining real-time monitoring and automated reports.

For example, if manual evidence validation takes 40 QSA hours (around $12,000–$16,000), automation can reduce that to 20 hours ($6,000–$8,000). That single improvement saves $6,000–$8,000 per year.

Optimize scope through segmentation

Network segmentation isolates the cardholder data environment from other systems. Fewer systems in scope mean fewer controls to audit. Organizations with strong segmentation typically reduce audit costs by 30 to 50 percent.

Address client-side security early

Requirements 6.4.3 and 11.6.1 have quickly become compliance blockers. Discovering client-side gaps during the audit often leads to delays, extended QSA engagement, and additional costs. The most efficient teams start six months ahead, implement monitoring, and collect at least two quarters of evidence before the audit.

Choose the right QSA

It’s worth asking prospective QSAs how they evaluate client-side controls and what evidence formats they accept. Those familiar with automated monitoring tools tend to complete assessments more efficiently and provide clearer guidance.

Conclusion

The true cost of PCI DSS compliance goes far beyond the QSA invoice. For Level 1 merchants, realistic first-year budgets range from roughly $245,000 to $600,000, with ongoing annual costs between $160,000 and $350,000.

The most underestimated expenses include:

- Internal labor for evidence preparation (often 200–400 hours per year)

- Client-side security infrastructure for Requirements 6.4.3 and 11.6.1

- Continuous monitoring capabilities

- The widening gap between manual and automated approaches

From working with organizations navigating PCI DSS 4.0, we’ve seen how automation changes the equation. Real-time script monitoring turns 150 to 200 hours of quarterly manual work into continuous, audit-ready evidence that meets both QSA and security needs.

See how PaymentGuard AI automates compliance, book your free demo today.

Sources